- 合併收入 214 億美元

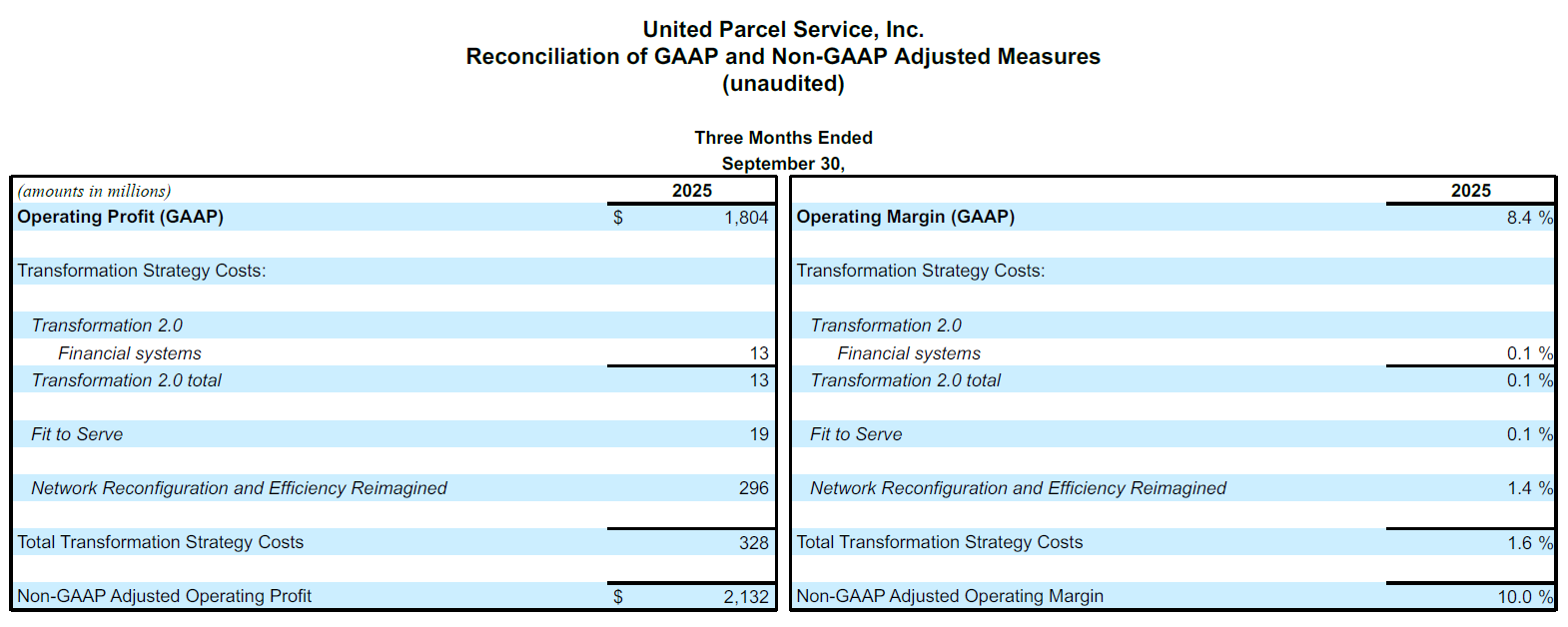

- 合併營業利潤率為 8.4%;非 GAAP 調整後的*合併營業利潤率為 10.0%

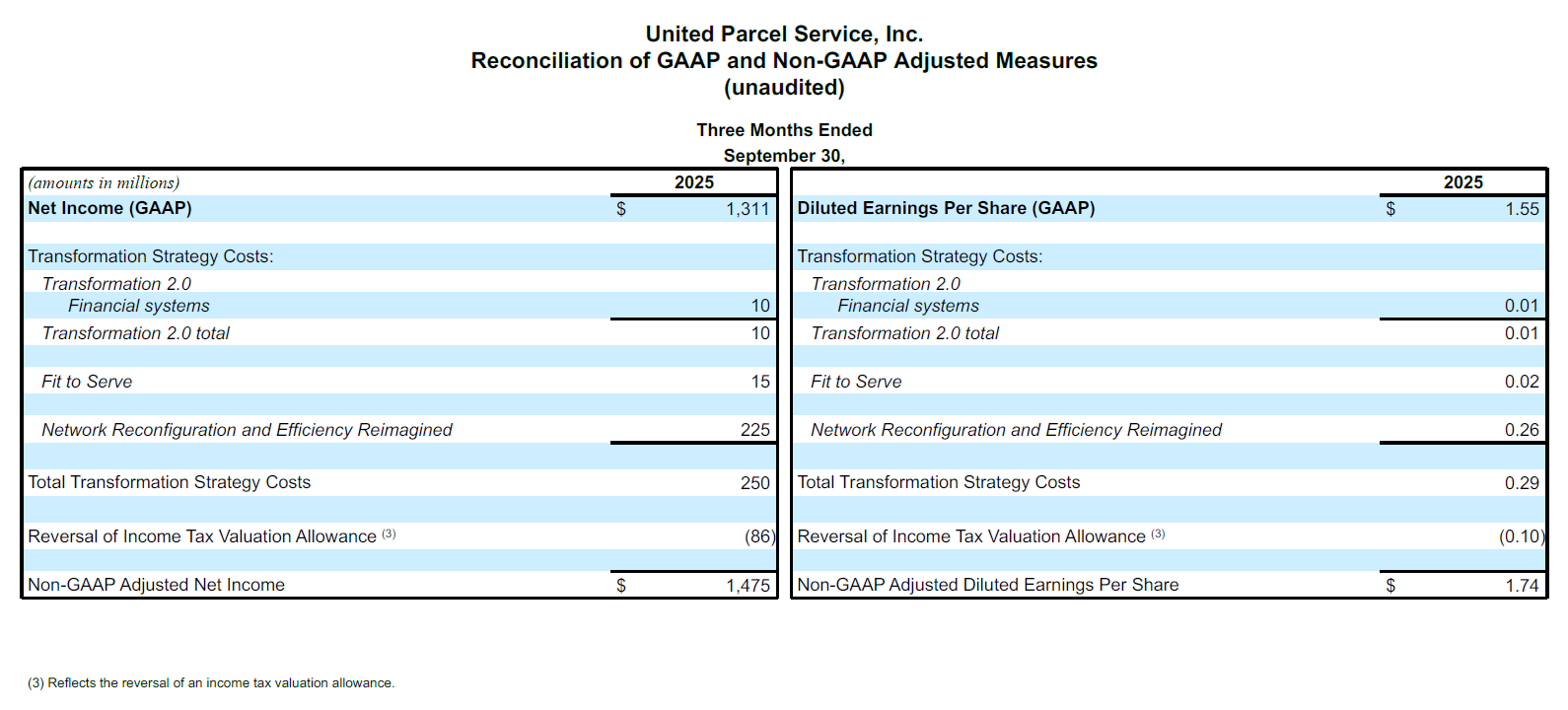

- 稀釋每股收益為 1.55 美元;非 GAAP 調整後的稀釋每股收益 1.74 美元

- 提供 2025 年第四季度財務指引和全年資本分配預期

亞特蘭大 - 2025 年 10 月 28 日 - UPS(紐約證券交易所代碼:UPS)今天宣布 2025 年第三季度合併收入為 214 億美元。合併營業利潤為 18 億美元;非 GAAP 調整後為 21 億美元。該季度的稀釋每股收益為 1.55 美元;非 GAAP 調整後的稀釋每股收益為 1.74 美元。

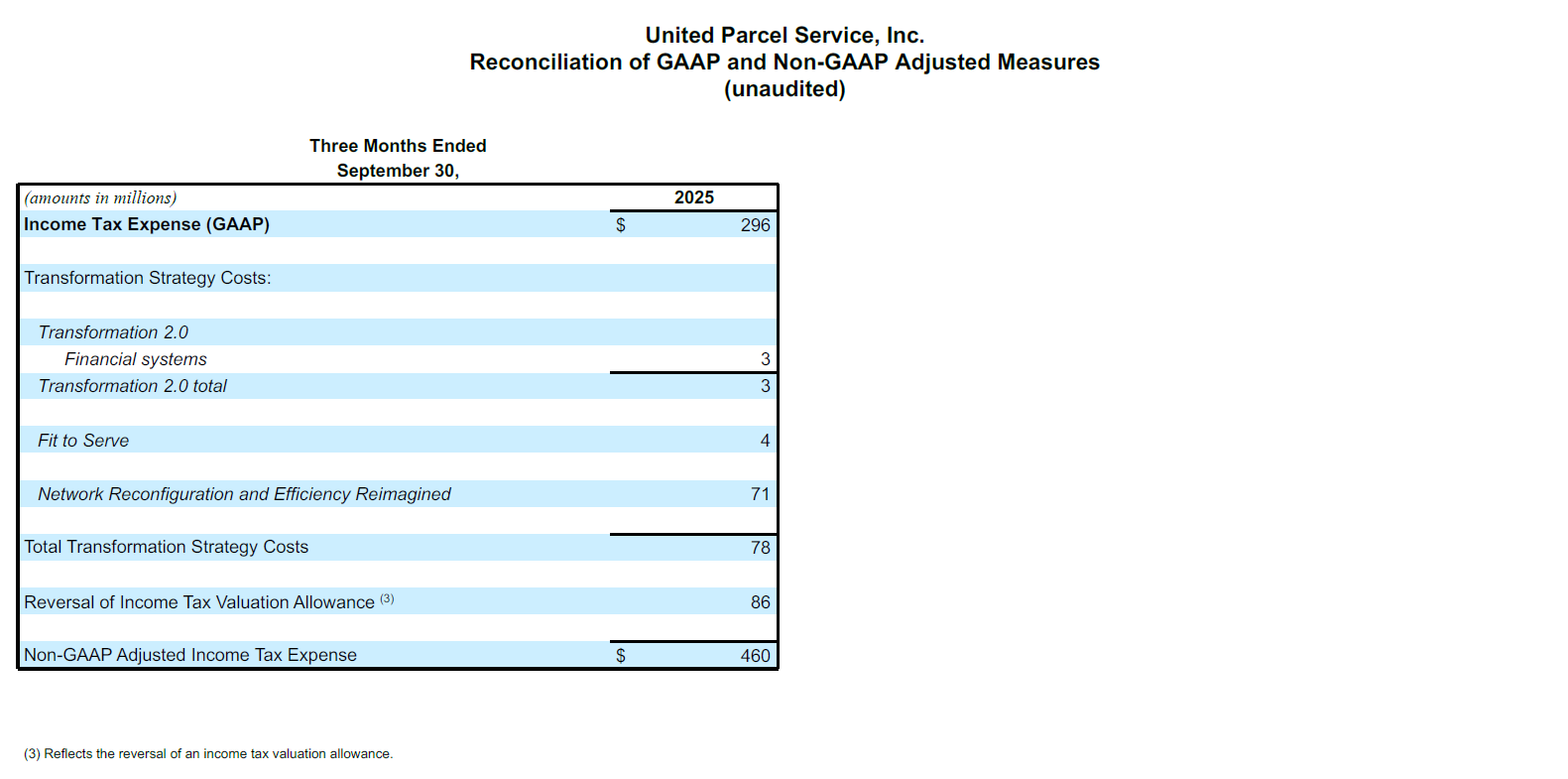

2025 年第三季度,GAAP 結果包括 1.64 億美元的淨費用,即每股攤薄支出 0.19 美元,包括 2.5 億美元的稅後轉型戰略成本,部分被沖回所得稅估值準備金帶來的 8,600 萬美元收益所抵消。

此外,第三季度 UPS 就五處物業達成了一項售後回租交易,這為供應鏈解決方案部帶來了 3.3 億美元的稅前銷售收益,並為稀釋後每股收益貢獻了 0.30 美元。此次交易是公司更廣泛資本運作戰略的一部分,旨在將某些不動產貨幣化,以進行再投資促進增長,且租賃結構意在維持營運的連續性。

UPS 行政總裁 Carol Tomé 表示說:「我要感謝所有 UPS 員工,謝謝他們對服務客戶的奉獻和堅定承諾。我們正在執行本公司歷史上最為重大的戰略轉變,而且我們正實施的變革旨在為所有利益相關方帶來長期價值。隨著假日運貨旺季臨近,我們已做好準備,要以空前高效的營運模式迎接高峰期,同時連續第八年為客戶提供業內領先的服務。」

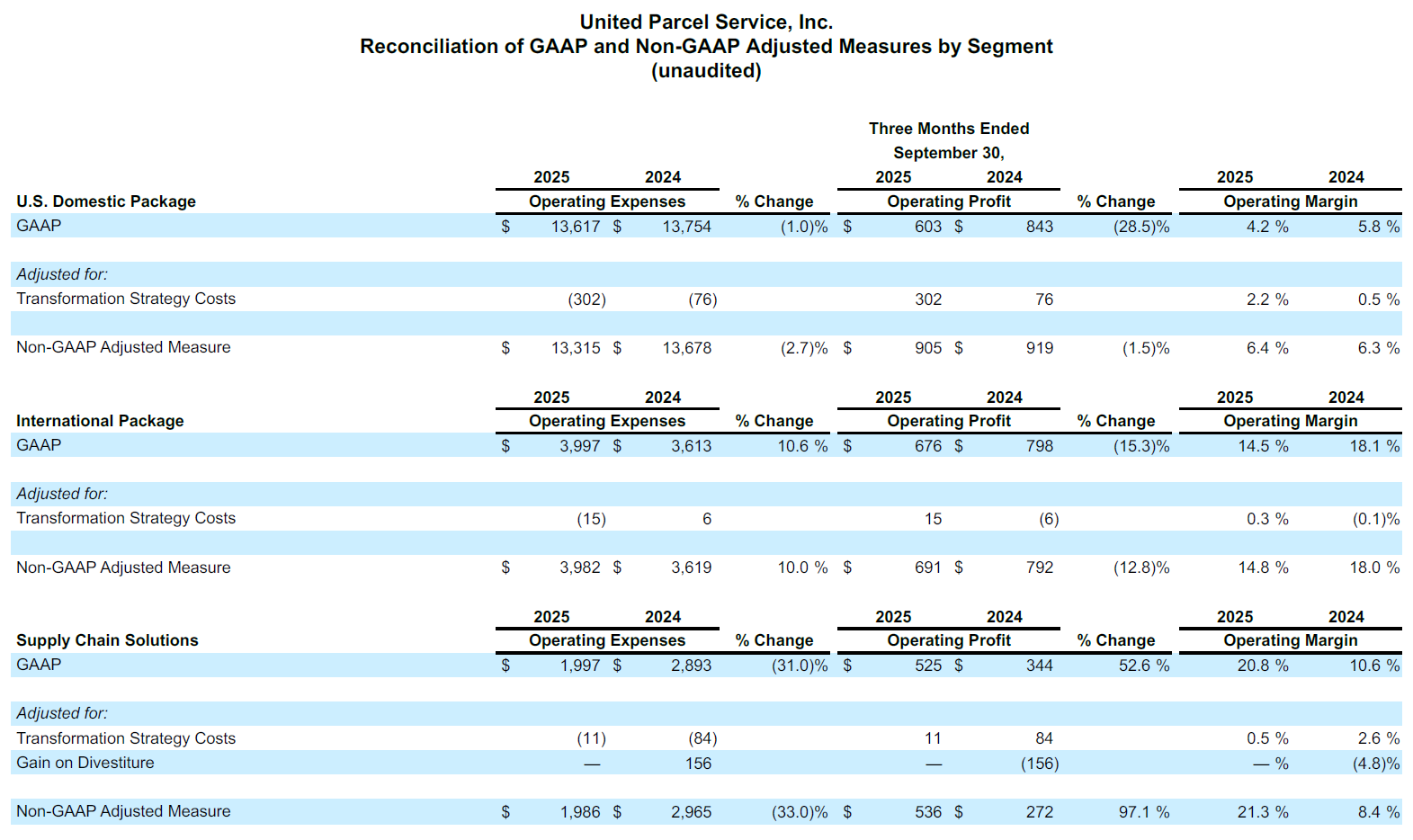

美國本土市場†

| 2025 年第三季度 | 非 GAAP | 2024 年第三季度 | 非 GAAP |

收益 | 14,220 百萬美元 |

| 14,597 百萬美元 |

|

營業利潤 | 603 百萬美元 | 905 百萬美元 | 843 百萬美元 | 919 百萬美元 |

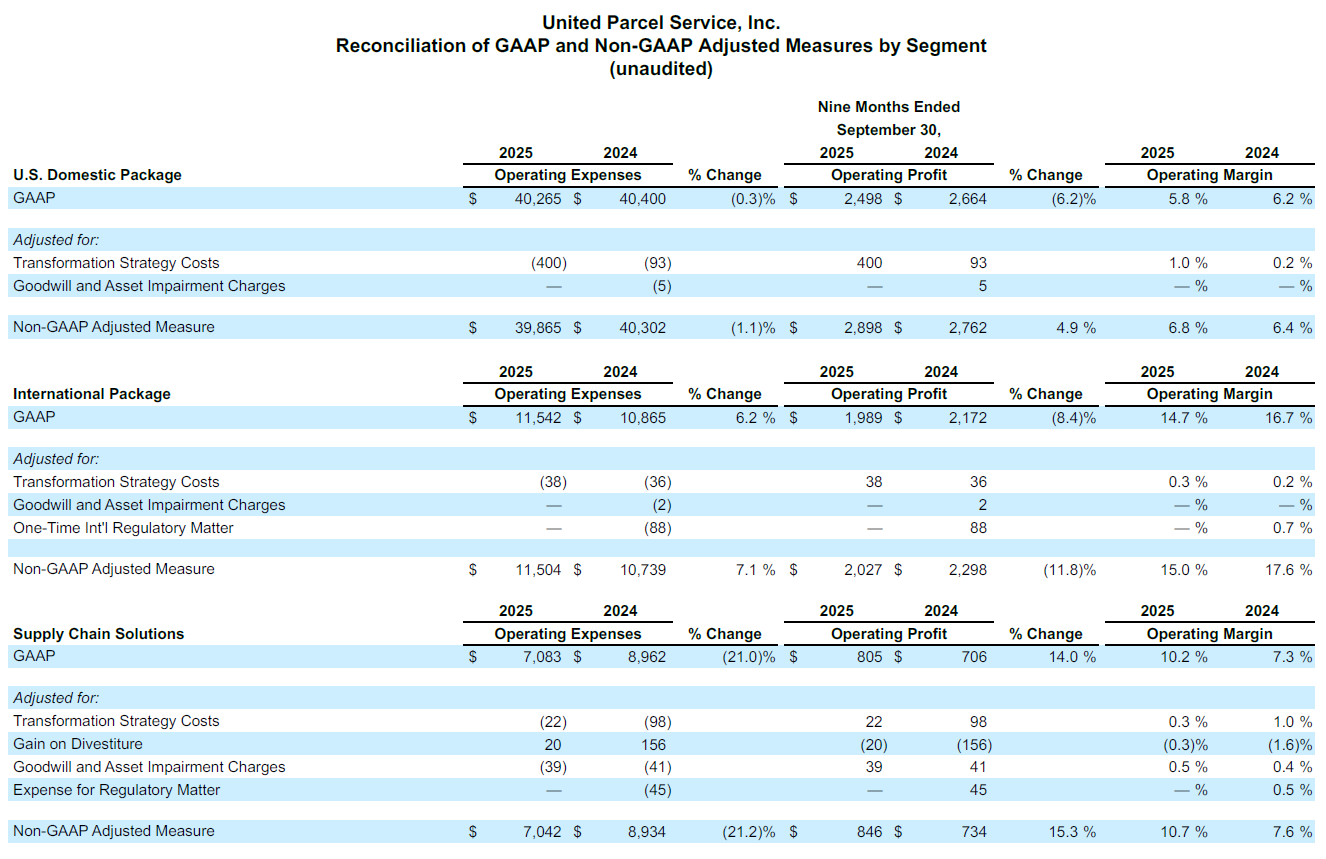

- 收入下降了 2.6%,主因是預期貨運量下降,但有一部分被單件收入和航空貨運收入的增量所抵消。

- 營業利潤率為 4.2%;非 GAAP 調整後的營業利潤率為 6.4%。

國際市場

| 2025 年第三季度 | 非 GAAP | 2024 年第三季度 | 非 GAAP |

收益 | 4,673 百萬美元 |

| 4,411 百萬美元 |

|

營業利潤 | 676 百萬美元 | 691 百萬美元 | 798 百萬美元 | 792 百萬美元 |

- 收益受日均交易量增長 4.8% 的推動,增長了 5.9%。

- 營業利潤率為 14.5%;非 GAAP 調整後的營業利潤率為 14.8%。

供應鏈解決方案1 †

| 2025 年第三季度 | 非 GAAP | 2024 年第三季度 | 非 GAAP |

收益 | 2,522 百萬美元 |

| 3,237 百萬美元 |

|

營業利潤 | 525 百萬美元 | 536 百萬美元 | 344 百萬美元 | $272 M |

1 包含根據 ASC 主題 280 - 分部報告,不滿足可報告部分之標準的經營部分。

- 收入下降 22.1%,主因是 2024 年第三季度剝離 Coyote 的影響。

- 營業利潤率為 20.8%;非 GAAP 調整後的營業利潤率為 21.3%。

2025 年展望

公司以非 GAAP 調整後的基礎提供某些指導,因為無法預測或提供反映各種潛在未來事件影響的調節表,包括養老金調整、某些戰略舉措或其他未預料到的事件的影響,這些影響將包含在報告的 (GAAP) 結果中,並且可能具有重大意義。

UPS 預計 2025 年第四季度合併收入約為 240 億美元,非 GAAP 調整後營業利潤率約為 11.0% - 11.5%。

本公司確認 2025 年全年業績如下:

- 資本支出約 35 億美元

- 預計股息支付額約為 55 億美元,需經董事會批准

- 有效稅率約為 23.75%

- 養老金繳款為 14 億美元(其中 13 億美元已繳)

- 約 10 億美元的股票回購已完成

* 「非 GAAP 調整後」或「非 GAAP 調整」金額是非 GAAP 調整後的財務指標。請參閱本新聞稿附錄,查看非 GAAP 調整後的財務指標討論,包括最密切相關的 GAAP 指標對賬。

† 前一年的某些金額已重新分類,以符合今年的列報,包括將空運貨物結果重新計入美國國內結果,但合併結果沒有變化。某些金額是依未四捨五入的數值算得。

聯絡人:

UPS 媒體關係:404-828-7123 或 pr@ups.com

UPS 投資者關係:404-828-6059 (選項 4)或 investor@ups.com

電話會議資訊

在 2025 年 10 月 28 日東部時間上午 8:30,UPS 行政總裁 Carol Tomé 與財務總裁 Brian Dykes 將與投資者及分析師討論第三季度績效。此次電話會議將透過網上直播供其他人觀看。若要聽取電話會議,請轉到 UPS 投資者關係頁面並點擊「財報電話會議」。其他財務資訊包含在 www.investors.ups.com 上「季度收益和財務」部分中公佈的詳細財務明細表中,內容與我們作為 8-K 表上「當前報告」之附表而呈交給 SEC 的內容一致。

關於 UPS

UPS (NYSE: UPS) 是全球最大的公司之一,2024 年收入超過 911 億美元,為 200 多個國家和地區內的客戶提供各種整合物流解決方案。公司的約 490,000 名員工專注於公司宗旨「透過遞送重要貨件,助力世界向前發展」,採用簡單表述和強力執行的策略:客戶至上。以人為本。創新驅動。UPS 致力於減少其對環境的影響,並支援我們在世界各地所服務的社區。查看更多資訊可瀏覽 www.ups.com、about.ups.com 和 www.investors.ups.com 。

預測性陳述

本新聞稿,我們截至 2024 年 12 月 31 日年度 10-K 表上「年度報告」及我們提交給證券交易委員會的其他備案檔中包含並在未來可能包含「預測性陳述」。除當前或歷史事實之外的聲明,及所有帶有「將要」、「相信」、「預測」、「預期」、「估計」、「假定」、「打算」、「預料」、「目標」、「計劃」及類似術語,均為預測性陳述。

我們也會不時在其他公開披露的材料中納入書面或口頭的預測性陳述。預測性陳述可能與我們對策略方向、前景、未來結果或未來活動的意圖、信念、預測或目前預期有關;它們與歷史或目前的事實並無確切聯系。管理層認為,這些預測性陳述在作出時是合理的。但是,應注意不要過度依賴任何預測性陳述,因為此類陳述就其性質而言僅截至發表之日,且無法肯定地預測未來。

預測性陳述存在某些風險與不確定性,這些風險和不確定性可能導致實際結果與我們的歷史經驗及我們當前的預期或預期結果之間存在重大差異。這些風險與不確定性包括但不限於:美國,或國際總體經濟狀況的變化,包括全球貿易政策變化、新增或加徵的關稅或政府停擺等因素導致的變化;當地、區域、全國和國際各層面上的重大競爭;我們與重要客戶之關係變化;吸引及留住稱職員工的能力;我們員工的罷工、停工或怠工;物理或運營安全要求增加或更加複雜;重大網絡安全事故或增多的資料保護法規;我們維護我們品牌形象之能力;全球氣候變化的影響;自然或人為活動或包括恐怖襲擊、流行病或疫情在內的疾病對我們的業務造成的中斷或影響;暴露於國際和新興市場內不斷變化的經濟、政治與社會發展;我們從收購、處置、合資企業或策略聯盟中實現預期收益之能力;能源價格變化的影響,包括汽油、柴油和航空煤油,以及這些商品供應的中斷;匯率或利率變化;我們準確地預測我們未來資本投資需求之能力;與員工健康、退休人員健康和/或退休津貼相關之費用或資金負擔增加;我們管理保險與索賠費用之能力;可能導致我們資產受損的業務策略、政府法規或經濟或市場狀況變化;潛在的額外美國或國際納稅義務;與氣候變化相關而日趨嚴格的監管;與勞動和就業、人身傷害、財產損失、商業慣例、環境責任及其他問題相關的潛在索賠或訴訟;以及其他在我們向證券交易委員會提交之文件中討論的其他風險,包括截至 2024 年 12 月 31 日的 10-K 表上的「年度報告」和隨後提交的報告。您應該考慮與預測性陳述有關之限制與風險,不應過度依賴此類預測性陳述中所含預測之準確性。除非法律有所要求,我們不承擔為了反映在這些聲明日期後之事件、情況、預期變化,或意料之外之事件而更新預測性陳述的任何義務。

公司定期在公司投資者關係網站 www.investors.ups.com 上發布重要資訊,包括新聞稿、公告、在分析師或投資者會議上提供或演示介紹的材料,以及其他有關其業務和經營業績的聲明,這些資訊可能對投資者至關重要。公司使用其網站作為披露重大非公開資訊及遵守公平披露規則下公司履行披露義務的手段。投資者除了關注公司的新聞稿、向美國證券交易委員會提交的檔案、公共電話會議和網絡廣播外,還應關注公司的投資者關係網站。我們不會將任何網站的內容納入本報告,或我們向美國證券交易委員會提交的任何其他報告中。

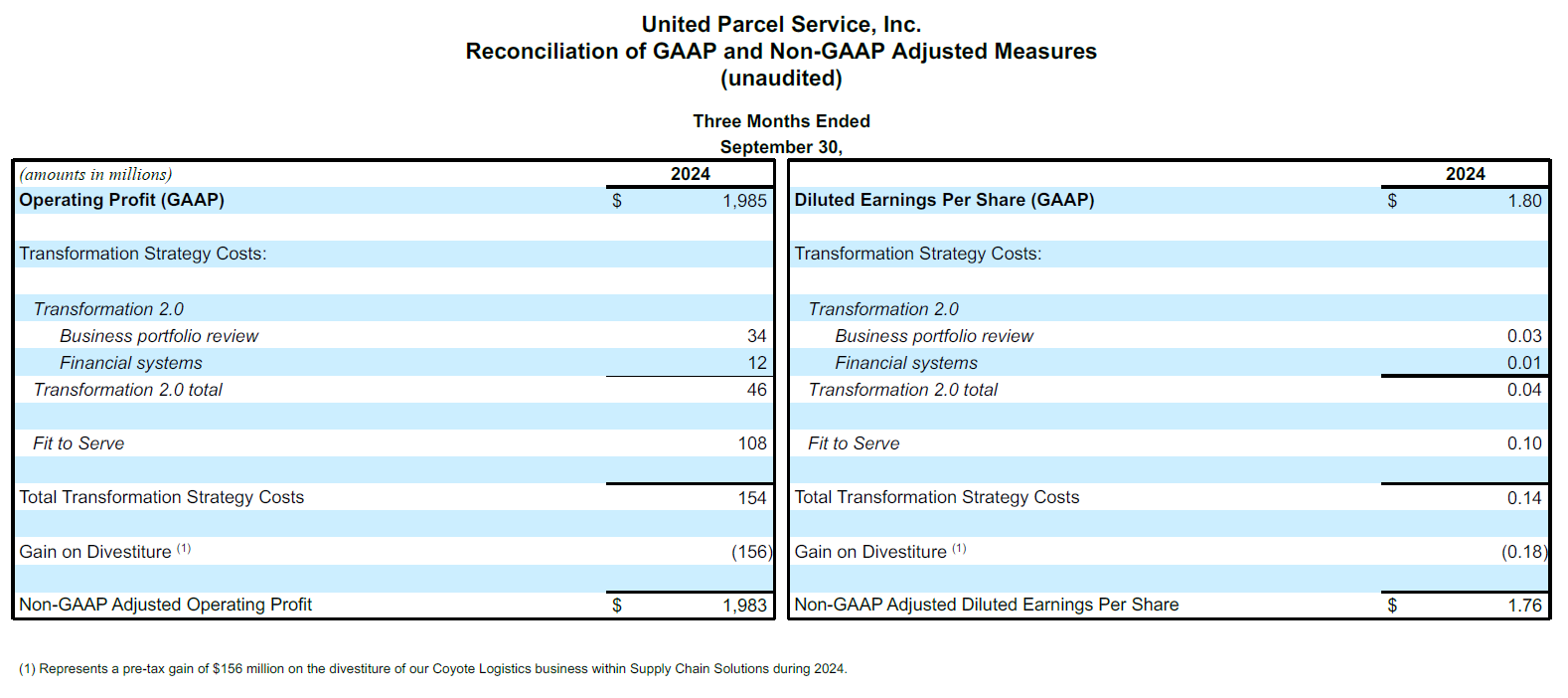

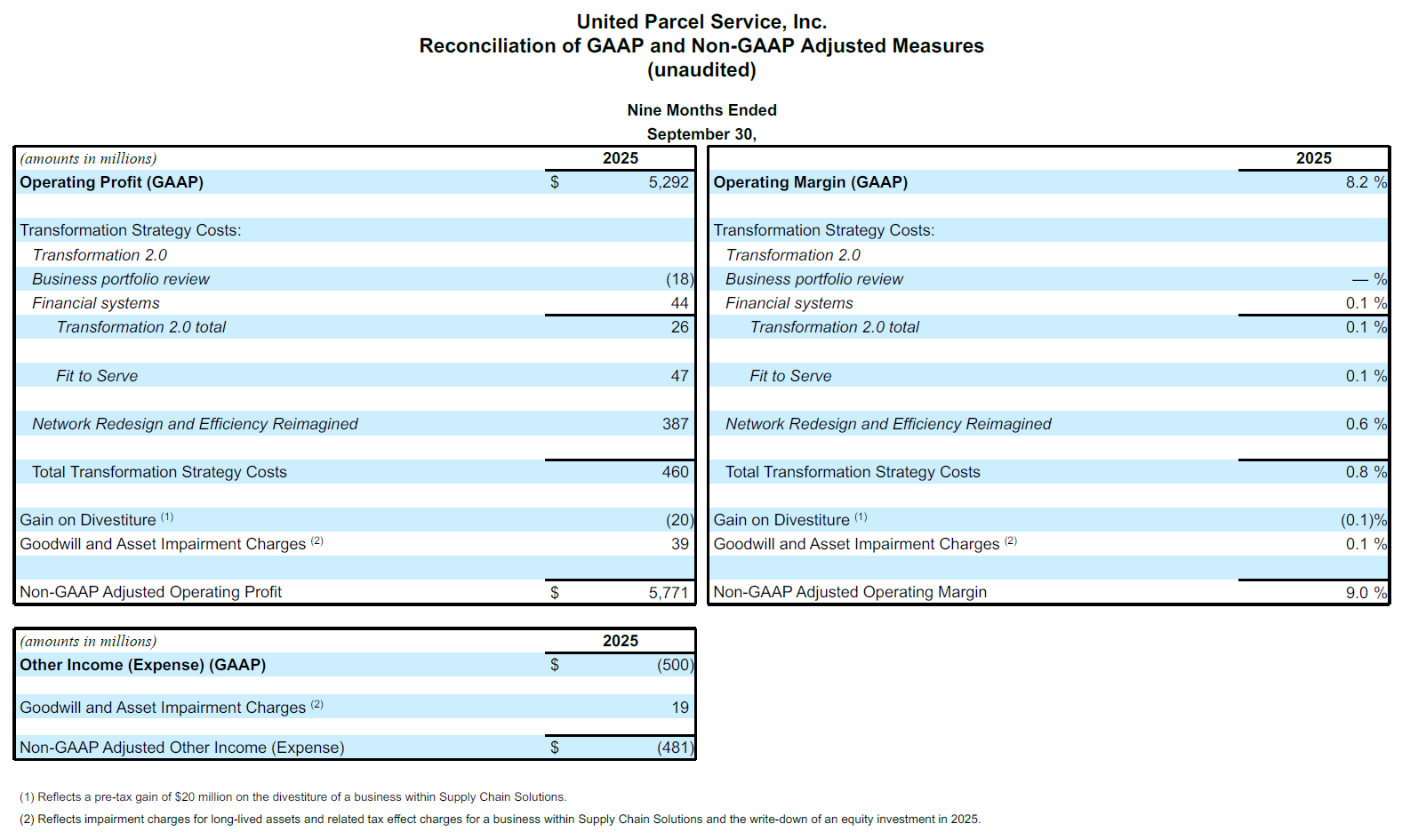

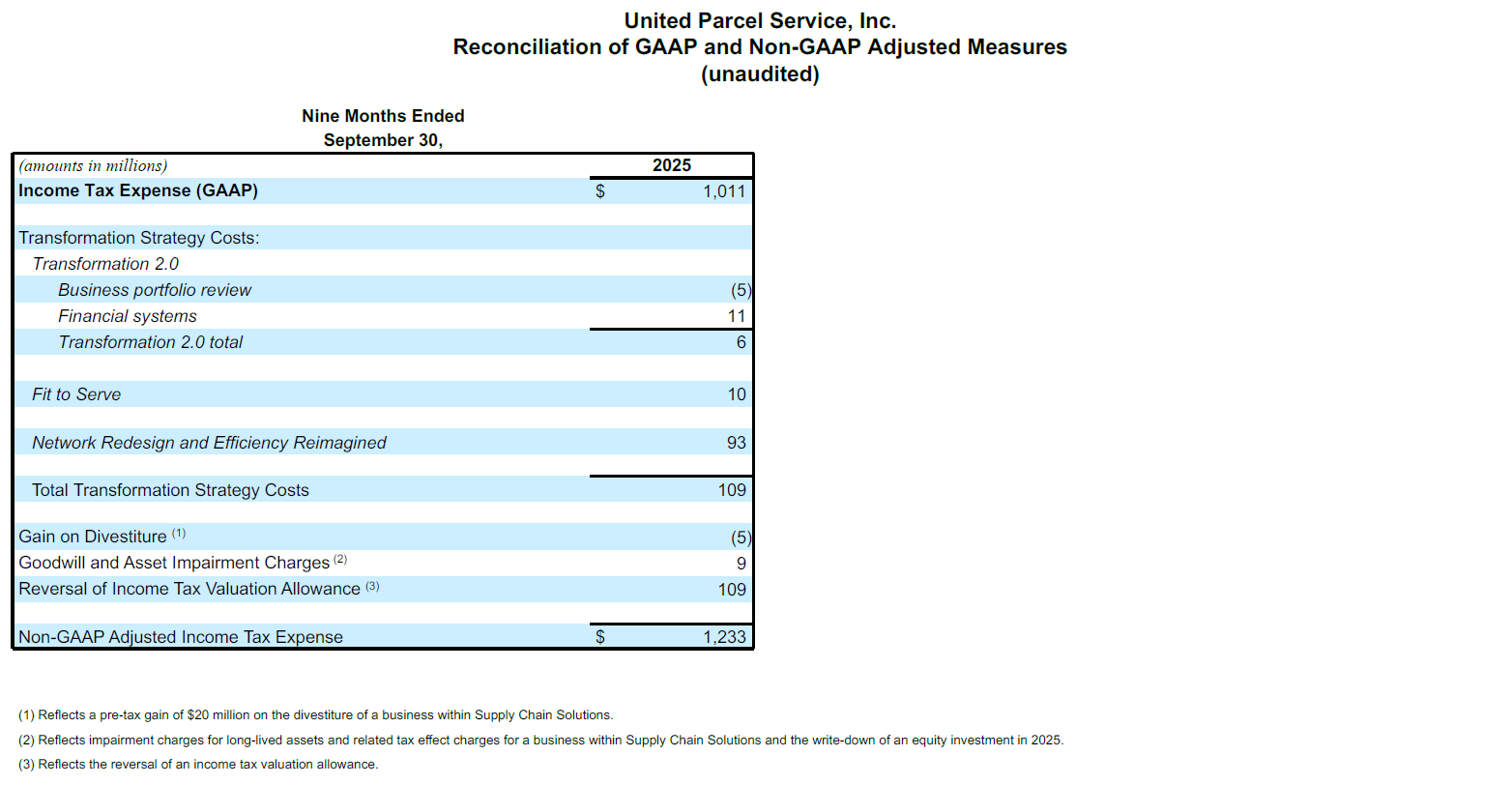

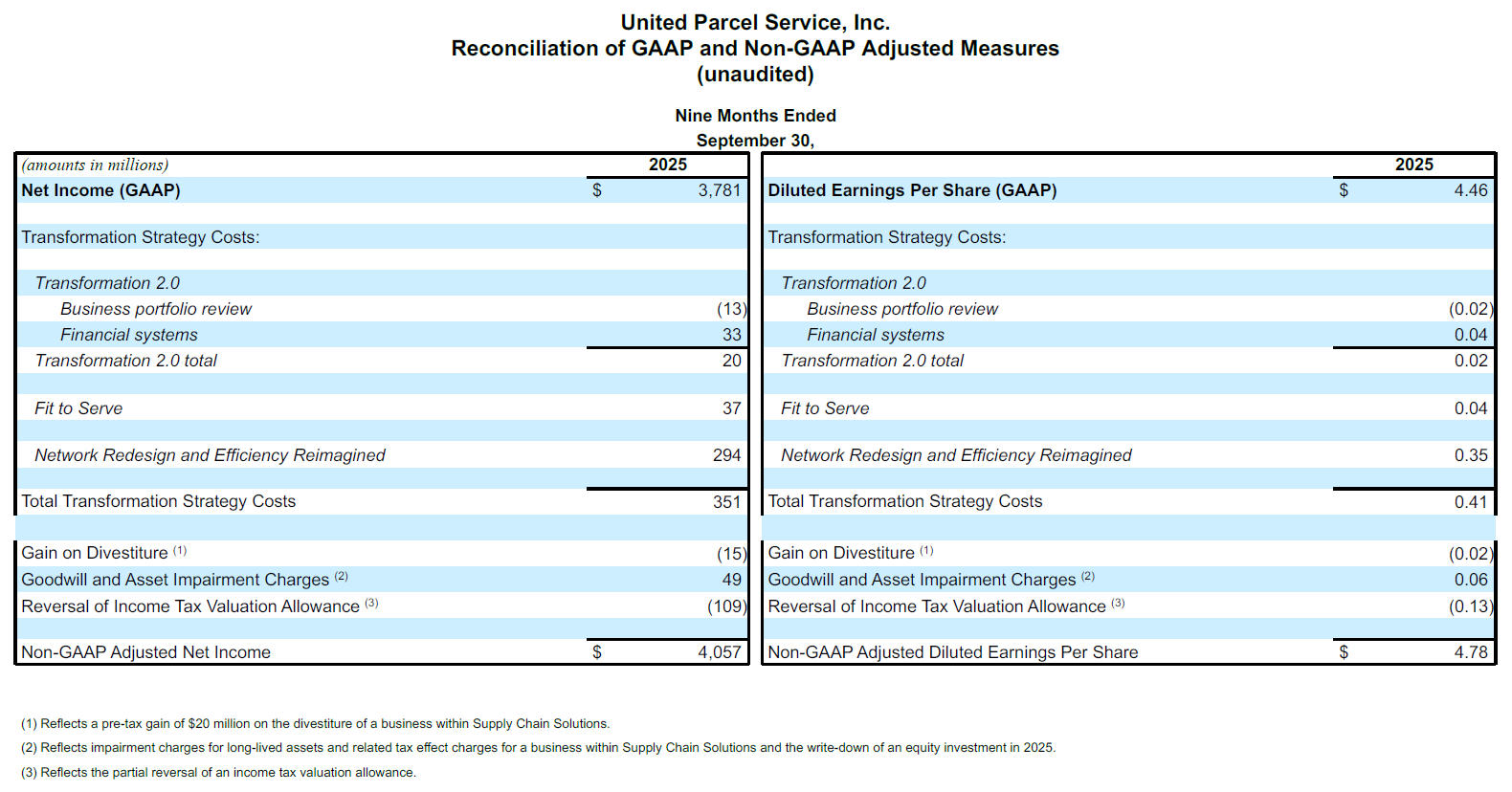

GAAP 和非 GAAP 調整後的財務指標調節

我們會以某些非 GAAP 調整後的財務指標,根據普遍接受的會計原則(「GAAP」)充實我們的財務資訊報告。管理層根據 GAAP 基礎並排除與這些非 GAAP 調整後財務指標相關的成本和收益來查看和評估業務績效。我們據此認為,這些非 GAAP 調整後財務指標的呈報能夠使我們的財務資訊使用者更好地從與管理層相同的視角來查看和評估基礎業務績效。

非 GAAP 調整後的財務指標應視為我們根據 GAAP 編制的報告結果的補充,而不是更替。我們非 GAAP 調整後的財務指標不代表綜合會計基準,因此無法與其他公司所報告的類似提法的指標作比較。

前瞻性非 GAAP 調整後的財務指標

有時,在展示前瞻性的非 GAAP 調整後財務指標時,我們無法提供與最密切相關的 GAAP 指標的定量對賬,因為任何調整的時間、金額或性質都存在不確定性,而這些調整在任何時期都可能具有重大意義。

監管事務費用

我們已排除此前所披露之監管事項和解費用的影響。我們認為這不屬於我們正在運行的業務的一部分,並且我們預期這種或類似支出不會再度發生。

國際監管事務的一次性付款

我們已排除為和解此前所披露之國際稅務監管事項所支付款項的影響。我們認為這筆付款不屬於我們正運行業務的一部分,並且我們不希望這筆付款或類似付款再度發生。

轉型策略成本

我們不計入與轉型戰略活動相關的費用影響。我們的轉型策略活動已持續數年,旨在從根本上改變組織架構的層級與範圍、流程、技術,以及業務組合的組成。我們的轉型戰略包括轉型 2.0、Fit to Serve,以及網絡重構和效率重塑計劃中的舉措。

各種情況促成了這些舉措,包括對某些投資的確定和優先排序、競爭格局的發展和變化、通脹壓力、消費者行為以及其他因素(包括 COVID 後的正常化和 2023 年勞資談判導致的數量轉移)。

我們的轉型戰略包括以下計劃和舉措:

Transformation 2.0:我們發現可減少管理層級與範圍的機會,並展開業務組合檢視,確定投資於部分技術的可能性,包括財務報告系統及部分排班、時間與薪酬系統,以降低全球間接營運成本、提升透明度,並減少對舊有系統及編碼語言的依賴。與 Transformation 2.0 相關的成本主要包括因裁減人手而產生的薪酬及福利支出,以及支付給第三方顧問的費用。我們預計所有餘留成本將在 2025 年餘下時間產生。

Fit to Serve:我們推行了「Fit to Serve」計劃,旨在調整業務規模,打造更高效的營運模式,以更靈活應對市場變化,並透過約 14,000 個職位的裁減,主要集中於管理層。我們預計所有餘留成本將在 2025 年餘下時間產生。

Network Reconfiguration and Efficiency Reimagined 計劃:我們的「未來網絡」(Network of the Future)計劃旨在透過自動化及整合美國國內分揀作業,提高網絡效率。為了配合我們最大客戶計劃的銷量下降戰略執行,我們啟動了網絡重組計劃,這是未來網絡的擴充,已經並將繼續引領我們設施和員工隊伍的整合以及端到端流程的重新設計。我們亦啟動了 Efficiency Reimagined 計劃,推動端到端流程的全面重塑,確保組織流程與網絡重組相互配合。作為這項計劃的一部分,我們在 2025 年頭九個月期間減少了約 34,000 個營運崗位,並關閉了 93 棟租賃和自有建築的日常營運。我們將繼續審查空中和地面綜合網絡的預期業務量變化,以確定需要關閉的其他建築物。截至 2025 年 9 月 30 日,我們已透過這項舉措節約了大約 22 億美元的成本,預計到 2025 年,每年將節省 35 億美元的成本。這些金額是根據我們最大客戶的年銷量變化算得,同時考慮到我們所選服務的某些額外銷量的影響。

就上述網絡重組和效率重塑計劃而言,我們預計在 2025 年將扣除 4 億美元至 6.5 億美元的非 GAAP 調整費用,主要涉及第三方諮詢費、員工離職福利和某些計劃費用。截至 2025 年 9 月 30 日,我們已產生計劃成本 4.22 億美元,包括迄今為止已產生的 3.87 億美元。若未來決定關閉更多設施,相關成本有可能進一步增加。這些舉措預計將於 2027 年收案。

我們不將相關成本視為日常費用,原因是每個計劃涉及獨立且不同的活動,可能跨越多個期間,且預期不會帶來額外收入,此外,這些計劃的規模亦超出常規持續提升盈利能力的範疇。這些舉措是對提高業務績效的常規和持續努力的補充。

商譽及資產減值

我們排除了商譽和某些資產減值費用的影響,包括長期資產和權益法投資的減值。在評估我們業務部門的經營業績、做出資源配置決定或確定激勵性薪酬獎項時,我們不會考慮這些費用。

與資產剝離相關的損益

我們未計入與剝離業務相關之收益(或損失)的影響。我們認為這些交易不屬於我們持續經營的組件,而我們在評估業務部門的經營業績、制定資源配置決策或確定激勵性薪酬獎勵時,也不會考慮這些交易的影響。

所得稅估值備抵的沖銷

我們之前記錄了導致預計無法實現的資本損失遞延稅項資產的交易的非 GAAP 調整。由於 2025 年的物業出售,我們現在預計會遭遇所有這些資本損失。我們用非 GAAP 調整後的財務指標來增補我們的呈報,這些指標不包括估值備抵變動逆轉對這些遞延稅項資產的影響,因為我們認為這種處理方式與最初確定估值備抵的方式一致。

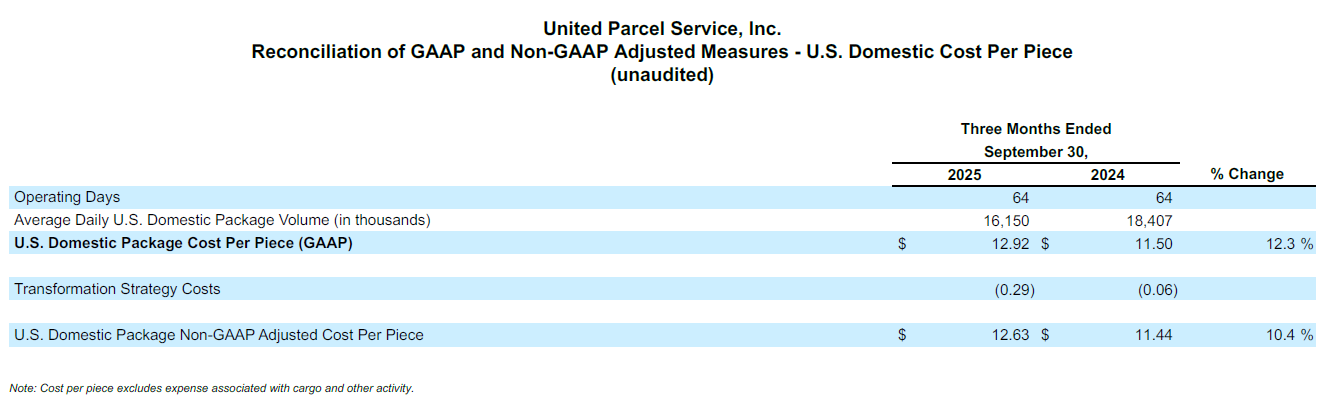

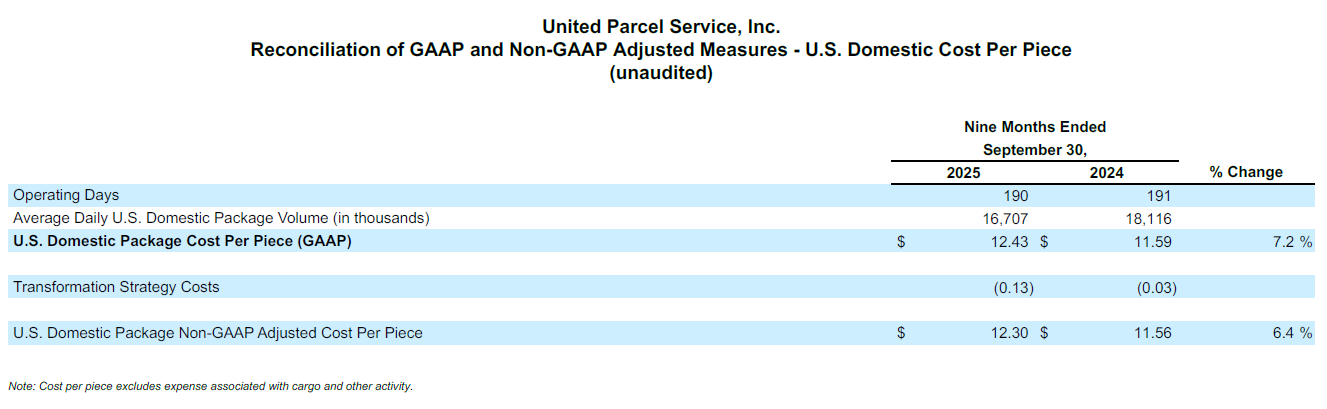

非 GAAP 調整後的每件成本

我們利用各種指標來評估我們的營運效率,包括非 GAAP 調整後的每件成本。非 GAAP 調整後每件成本的算法是將某一期間的非 GAAP 調整後營業費用除以該期間的總量。由於非 GAAP 調整後的營業費用不包括我們在監控和評估業務部門的營運績效、做出資源配置決策,或確定激勵性薪酬獎勵時不視為基本業務績效一部分的成本或費用,因此,我們認為這是審查和評估我們營運表現效率的適當指標。

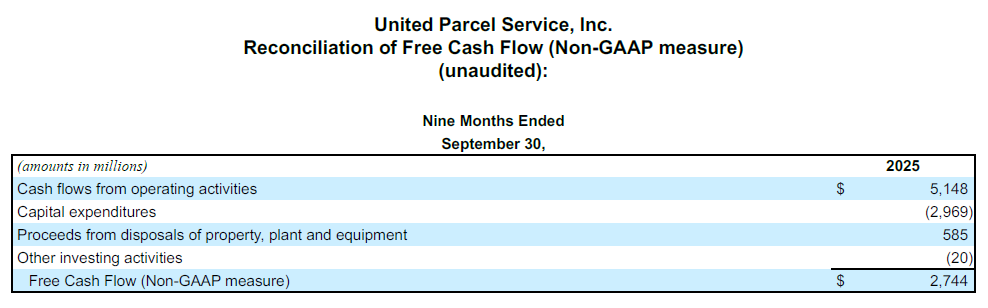

自由現金流

我們計算自由現金流的方式如下:營業活動的現金流減去資本支出、處理財產、廠房及設備所得款項,再加上或減去其他投資活動的淨變。我們認為自由現金流為持續經營活動所產生之現金量的重要指標,我們會用其來估量可用於投資我們的業務、履行我們的債務及向股東返還現金之增量現金。