- 合併收入為 218 億美元,同比之下去年為 221 億美元

- 合併營業毛利為 8.9%;*合併調整後營業利潤為 9.5%

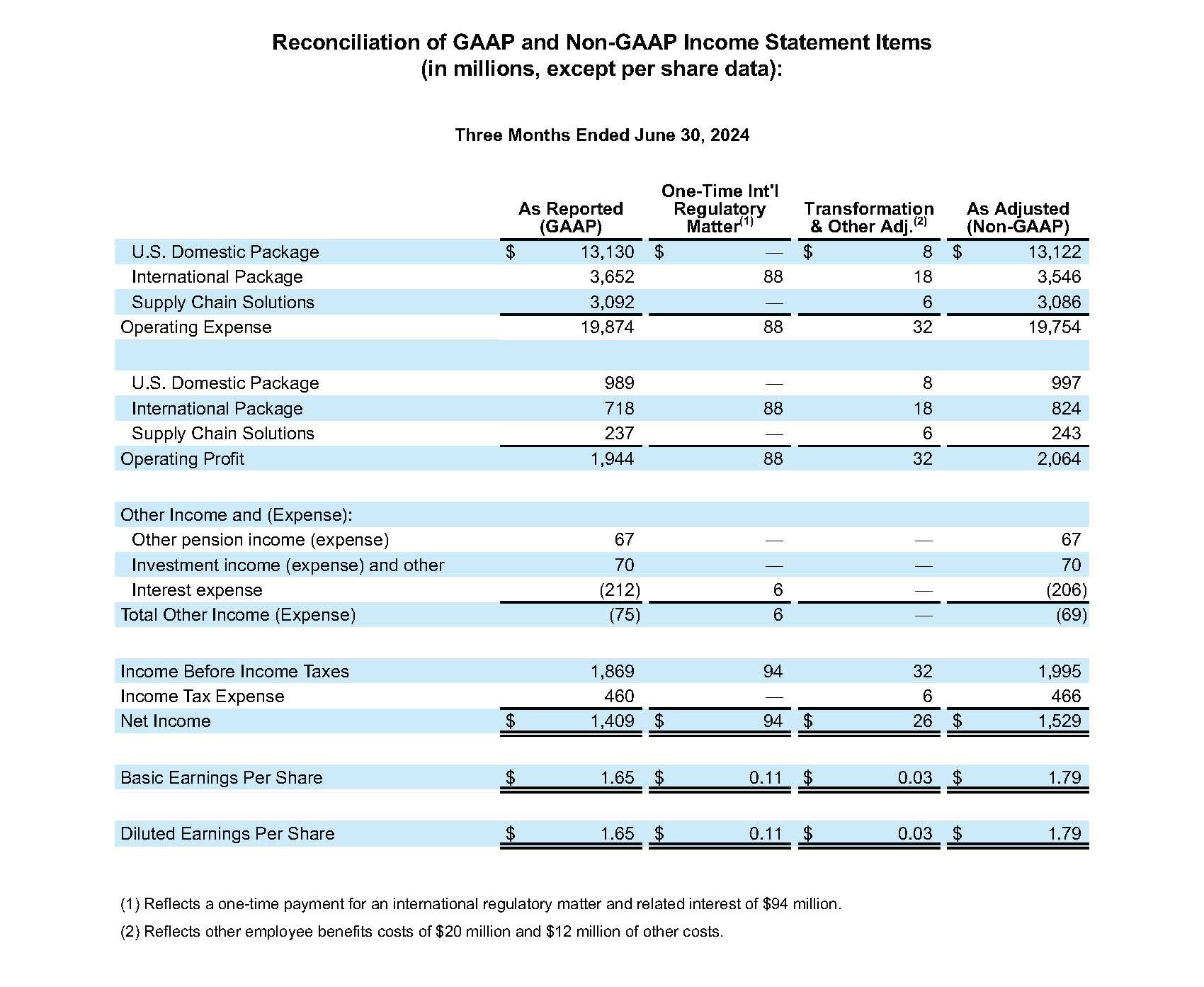

- 稀釋每股收益為 1.65 美元;調整後的稀釋每股收益為 1.79 美元,相比之下去年為 2.54 美元

- 更新 2024 年全年財務指引;重啟股票回購計劃,目標為每年 10 億美元

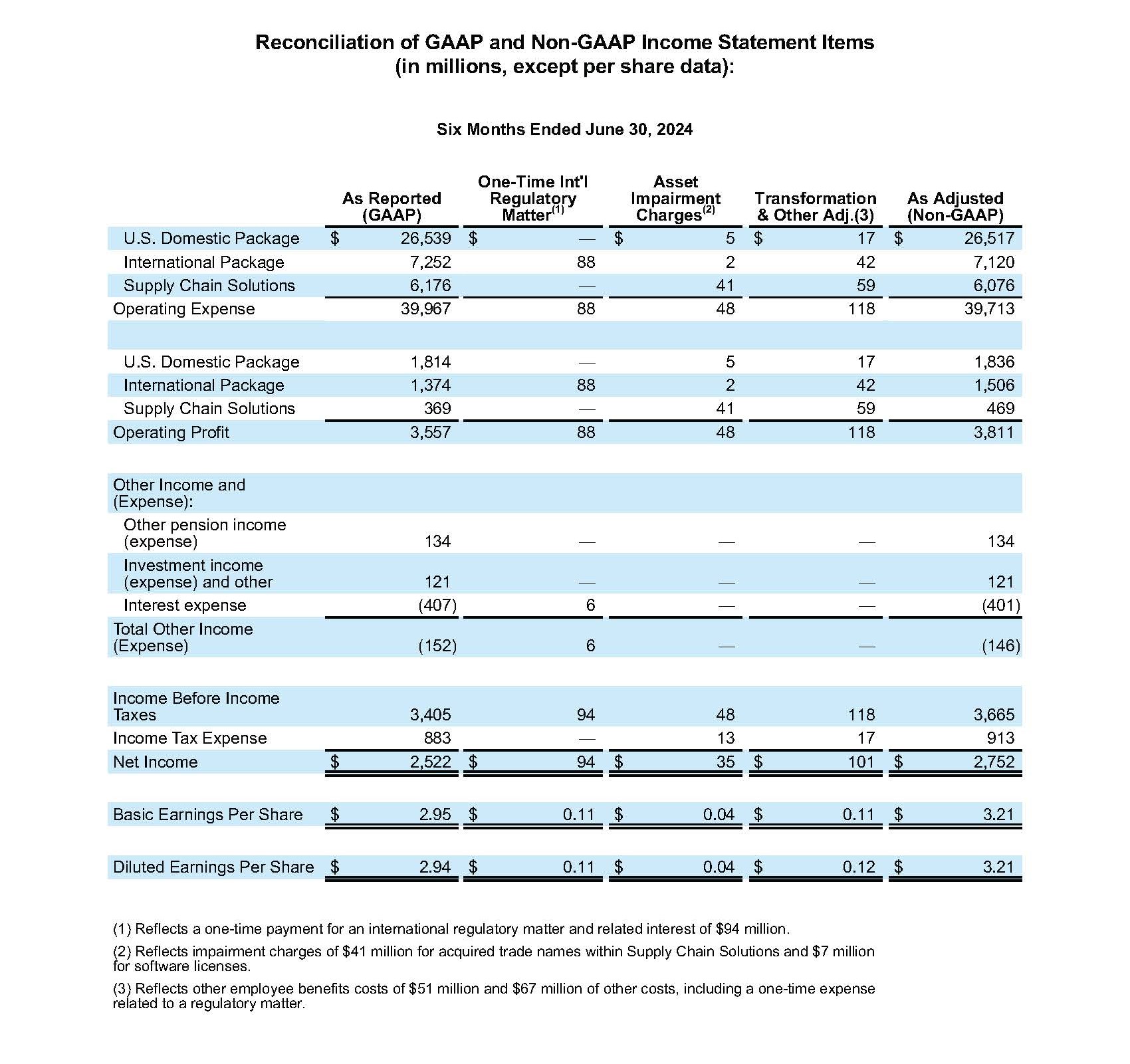

亞特蘭大 - 2024 年 7 月 23 日 - UPS (NYSE:UPS) 今日宣佈其 2024 年第二季度合併收入為 218 億美元,同比 2023 年第二季度減少了 1.1%。合併營業利潤為 19 億美元,與 2023 年第二季度相比下降了 30.1%,在調整後的基礎上,錄得 29.3% 下跌。該季度的稀釋每股收益為 1.65 美元;調整後的稀釋每股收益為 1.79 美元,與 2023 年同期相比下跌了 29.5%。

2024 年第二季度,GAAP 結果包括 1.2 億美元的稅後費用,即每股攤薄收益 0.14 美元,當中包括一次性支付 9,400 萬美元來解決國際監管問題,以及 2,600 萬美元的轉型和其他費用。

「我要感謝全體 UPS 員工在第二季度的辛勤工作和努力,」UPS 行政總裁 Carol Tomé 說。「本季度對公司來說就是一個重要的轉捩點,因為在美國市場,我們是九個季度以來首次恢復銷量增長。正如預期的那樣,2024 年上半年我們的營業利潤較去年同期有所下降。展望未來,我們預計營業利潤將會恢復增長。」

美國本土市場

|

2024 年第二季度 | 調整後的 2024 年第二季度 |

2023 年第二季度 | 調整後的 2023 年第二季度 |

收益 | 14,119 百萬美元 |

| 14,396 百萬美元 |

|

營業利潤 | 989 百萬美元 | $997 M | 1,602 百萬美元 | 1,681 百萬美元 |

- 收入下降 1.9%,主要是因為產品結構變動導致每件的收入下降了 2.6%。

- 營業毛利為 7.0%;調整後的營業毛利為 7.1%。

國際市場

|

2024 年第二季度 | 調整後的 2024 年第二季度 |

2023 年第二季度 | 調整後的 2023 年第二季度 |

收益 | 4,370 百萬美元 |

| 4,415 百萬美元 |

|

營業利潤 | 718 百萬美元 | 824 百萬美元 | 883 百萬美元 | 902 百萬美元 |

- 收入下降了 1.0%,主因是日均交易量下降 2.9%。

- 營業利潤率為 16.4%;調整後營業利潤率為 18.9%。

供應鏈解決方案1

|

2024 年第二季度 | 調整後的 2024 年第二季度 |

2023 年第二季度 | 調整後的 2023 年第二季度 |

收益 | 3,329 百萬美元 |

| 3,244 百萬美元 |

|

營業利潤 | 237 百萬美元 | 243 百萬美元 | 295 百萬美元 | 336 百萬美元 |

1 包含根據 ASC 主題 280 - 分部報告,不滿足可報告部分之標準的經營部分。

- 收入增長了 2.6%,主要得益於醫療保健等物流業務的增長。

- 營業毛利為 7.1%;調整後的營業毛利為 7.3%。

2024 年展望

公司在調整的(非 GAAP)基礎上提供一定程度的指導,因為不可能預測或提供可反映未來退休金調整或其他未知或非預期的可能調整(這會包含在所報告的(GAAP)成果中且可能會是重大調整)之影響的對帳。

對於 2024 年,UPS 更新了其全年合併財務目標:**

- 預計合併收入約為 930 億美元

- 合併調整後營業利潤率預計約為 9.4%

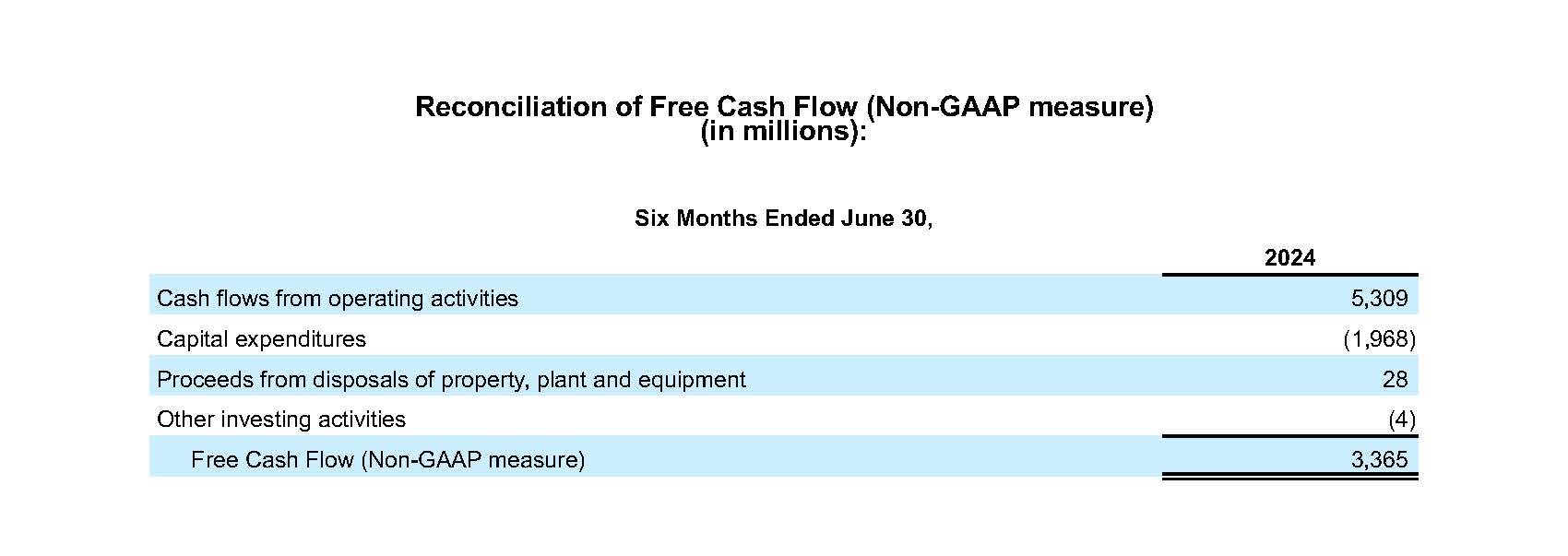

- 資本支出大約 40 億美元

- 股票回購目標約為 5 億美元

* 「調整後的」或「Adj.」金額為非 GAAP 財務指標。請參閱本新聞稿附錄,查看非 GAAP 財務指標討論,包括最密切相關的 GAAP 指標對賬。

**不包括 Coyote 待處置和已宣佈之收購的影響。

聯絡人:

UPS 媒體關係:404-828-7123 或 pr@ups.com

UPS 投資者關係:404-828-6059 (選項 4)或 investor@ups.com

# # #

電話會議資訊

在東部時間 2024 年 7 月 23 日 上午 8:30 ,UPS 行政總裁 Carol Tomé 與財務總監 Brian Dykes 將與投資者及分析師討論第二季度業績。此次電話會議將透過網上直播供其他人觀看。若要聽取電話會議,請前往 www.investors.ups.com 並點按「關於收益的電話會議」。其他財務資訊包含在 www.investors.ups.com 上「季度收益和財務」部分中公佈的詳細財務明細表中,內容與我們作為 8-K 表上「當前報告」之附表而呈交給 SEC 的內容一致。

關於 UPS

UPS (NYSE: UPS) 是全球最大的公司之一,2023 年收入超過 910 億美元,為 200 多個國家和地區內的客戶提供各種整合物流解決方案。公司的約 500,000 名員工專注於公司宗旨「透過遞送重要貨件,助力世界向前發展」,採用簡單表述和強力執行的策略:客戶至上。以人為本。創新驅動。UPS 致力於減少其對環境的影響,並支援我們在世界各地所服務的社區。UPS 在支援多元、平等及包容性方面立場堅定。查看更多資訊可瀏覽 www.ups.com、about.ups.com 和 www.investors.ups.com 。

預測性陳述

本新聞稿,我們截至 2023 年 12 月 31 日 年度 10-K 表上「年度報告」及我們提交給證券交易委員會的其他備案文件中包含並在未來可能包含《1995 年美國私人證券訴訟改革法案》意思範疇內的「預測性陳述」。除當前或歷史事實之外的聲明,及所有帶有「將要」、「相信」、「預測」、「預期」、「估計」、「假定」、「打算」、「預料」、「目標」、「計劃」及類似術語,均為預測性陳述。根據《1933年證券法》第 27A 條和《1934 年證券交易法》第 21E 條規定,預測性陳述應遵守聯邦證券法的安全港規則。

我們也會不時在其他公開披露的材料中納入書面或口頭的預測性陳述。預測性陳述可能與我們對策略方向、前景、未來結果或未來活動的意圖、信念、預測或目前預期有關;它們與歷史或目前的事實並無確切聯系。管理層認為,這些預測性陳述在作出時是合理的。但是,應注意不要過度依賴任何預測性陳述,因為此類陳述就其性質而言僅截至發表之日,且無法肯定地預測未來。

預測性陳述存在某些風險與不確定性,這些風險和不確定性可能導致實際結果與我們的歷史經驗及我們當前的預期或預期結果之間存在重大差異。這些風險與不確定性包括但不限於:美國,或國際總體經濟狀況的變化;當地、地域、全國和國際各層面上的重大競爭;我們與重要客戶之關係變化;吸引及留住稱職員工的能力;我們員工的罷工、停工或怠工;物理或運營安全要求增加或更加複雜;重大網絡安全事故或增多的資料保護法規;我們維護我們品牌形象之能力;全球氣候變化的影響;自然或人為活動或包括恐怖襲擊、流行病或疫情在內的疾病對我們的業務造成的中斷或影響;暴露於國際和新興市場內不斷變化的經濟、政治與社會發展;我們從收購、處置、合資企業或策略聯盟中實現預期收益之能力;能源價格變化的影響,包括汽油、柴油和航空煤油,以及這些商品供應的中斷;匯率或利率變化;我們準確地預測我們未來資本投資需求之能力;與員工健康、退休人員健康和/或退休津貼相關之費用或資金負擔增加;我們管理保險與索賠費用之能力;可能導致我們資產受損的業務策略、政府法規或經濟或市場狀況變化;潛在的額外美國或國際納稅義務;與氣候變化相關而日趨嚴格的監管;與勞動和就業、人身傷害、財產損失、商業慣例、環境責任及其他問題相關的潛在索賠或訴訟;以及其他我們不是向證券交易委員會提交之文件中討論的其他風險,包括 2023 年 12 月 31 日 止年度的 10-K 表上的「年度報告」以及後續提交的報告。您應該考慮與預測性陳述有關之限制與風險,不應過度依賴此類預測性陳述中所含預測之準確性。除非法律有所要求,我們不承擔為了反映在這些聲明日期後之事件、情況、預期變化,或意料之外之事件而更新預測性陳述的任何義務。

我們預計將不時參加分析師與投資者會議。在這些會議上提供或展示的材料,比如幻燈片和演示文稿,在可用時,可能會在我們的投資者關係網站 www.investors.ups.com 上的「演示文稿」標題下發佈。這些演示文稿可能包含關於我們公司非公開的新材料資訊,我們建議您密切關注該網站,了解任何最新發佈的內容,因為我們可能會使用此機制作為公共通告。

GAAP 和非 GAAP 財務指標調節

我們會以某些非 GAAP 財務指標,根據普遍接受的會計原則(「GAAP」)充實我們的財務資訊報告。

調整後的財務指標應視為我們根據 GAAP 編制的報告結果的補充,而不是更替。我們調整後的財務指標不代表綜合會計基準,因此無法與其他公司所報告的類似提法的指標作比較。

預測性非 GAAP 指標

在不時提出我們的預測性非 GAAP 指標時,由於任何調整(這些調整在任何時期內都可能是重大調整)的時機、數量或性質的不確定性,我們無法向最密切相關的 GAAP 指標提供定量對帳。

國際監管事務的一次性付款

2024 年第二季度,我們一次性支付了 9400 萬美元的先前受限現金,以解決意大利稅務機關先前披露的對 UPS 向某些第三方服務提供者支付的增值稅可扣除性的質疑,對該質疑的審查已於 2023 年第四季度啟動。我們以非 GAAP 指標(不包括這筆費用的影響)補充表述營業利潤、營運毛利、利息支出、其他總收入(支出)、稅前收入、淨收入及每股收益。我們認為,排除這筆付款的影響(我們認為其不歸入我們持續經營的一部分,也不預期會再次發生)可以使我們的財務報表使用者更好地從與管理層相同的角度查看和評估基礎業務績效。

轉型和其他成本以及資產減值費用

我們以非 GAAP 指標(不包括與轉型活動、資產減值和其他費用的影響)補充表述營業利潤、營運毛利、稅前收入、淨收入及每股收益。我們認為,排除這些費用的影響便能讓我們財務報表的使用者更好地使用管理層的視角來查看和評估基本業務績效。在評估我們業務部門的經營業績、做出資源配置決定或確定激勵性薪酬獎項時,我們不會考慮這些成本。

一次性補償金

我們以非 GAAP 指標(不包括在我們與 Teamsters 的勞資協議獲得批准後,向某些美國非工會主管的一次性支付的影響)補充表述營業利潤、營運毛利、稅前收入、淨收入及每股收益。我們預計此類或類似付款不會再次發生。我們認為,排除這筆一次性支付的影響便能讓我們財務報表的使用者更好地使用管理層相同的視角來查看和評估基本業務績效。

固定福利退休金和退休後醫療計劃損益

我們認可計劃資產的公允價值變動及超出 10% 幅度的保險統計損益(定義為計劃資產公允價值或計劃的預測給付義務之間取較大者的 10%),以及計劃縮減和解決導致的損益,因為我們的退休金和退休後固定福利計劃直接定義為投資收入(費用)及合併收入報表中其他專案的一部分。我們以調整後的指標補充所得稅前收入、淨收入和每股收益,這些指標不包括這些損益和相關所得稅的影響。我們認為,排除這些固定福利養老金和退休後計劃的損益,可以消除與計劃修訂以及市場利率、股權價值和類似因素的短期變化相關的波動性,從而提供重要的補充資訊。

自由現金流

我們計算自由現金流的方式如下:營業活動的現金流減去資本支出、處理財產、廠房及設備所得款項,再加上或減去其他投資活動的淨變。我們認為自由現金流為持續經營活動所產生之現金量的重要指標,我們會用其來估量可用於投資我們的業務、履行我們的債務及向股東返還現金之增量現金。

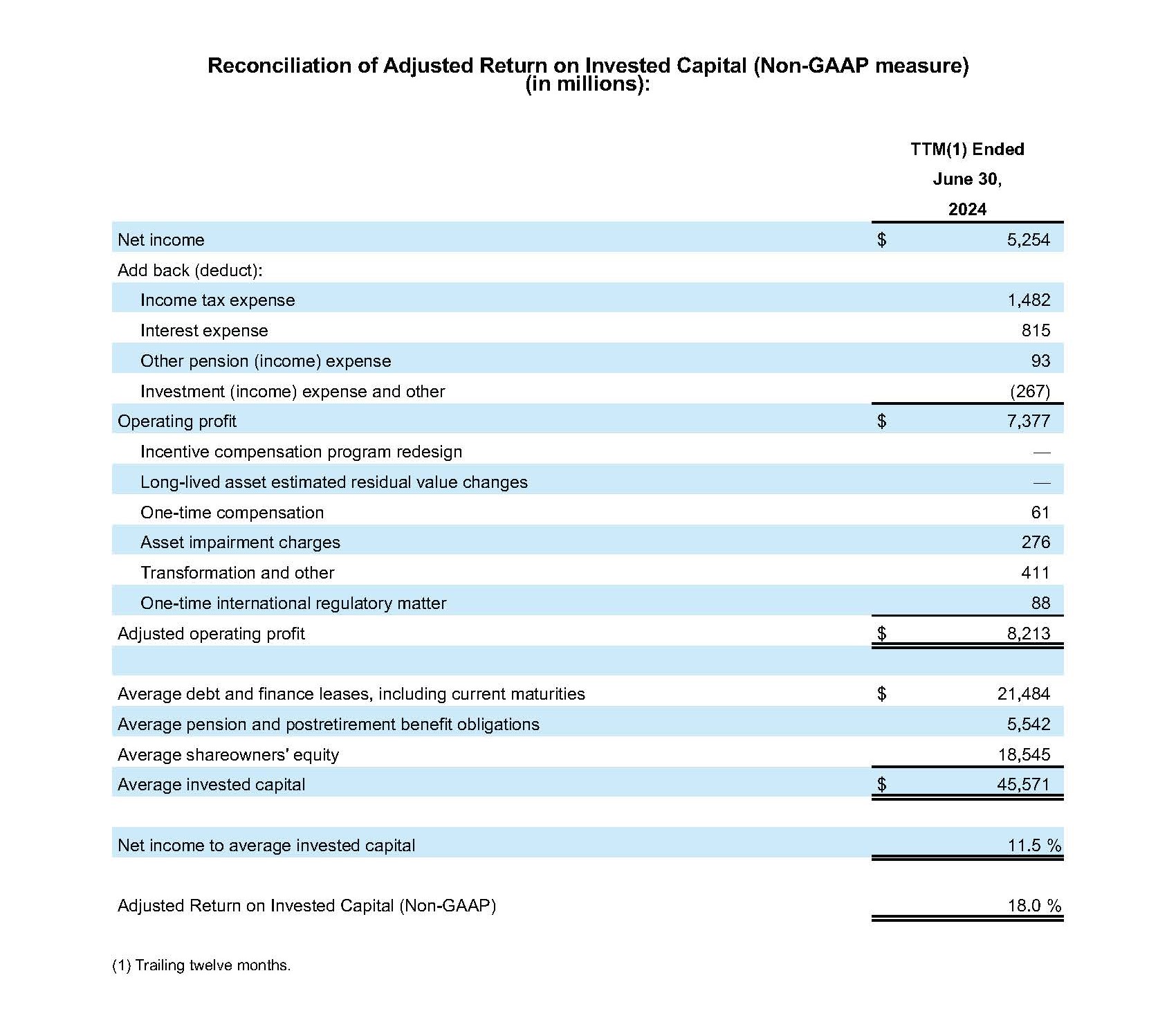

調整後的投資回報

調整後的 ROIC 的計算方式如下:在當期結束時及上一年對應時期結束時,用調整後營運收入後十二個月 (「TTM」) 除以總債務、非當期養老金和退休後福利義務與股東權益的平均數。由於調整後的 ROIC 並非 GAAP 規定的指標,我們計算它時有部分是使用我們認為最能表示我們持續營運業績的非 GAAP 財務指標。我們認為調整後的 ROIC 是評估我們長期資本投資之有效性和效率的實用指標。

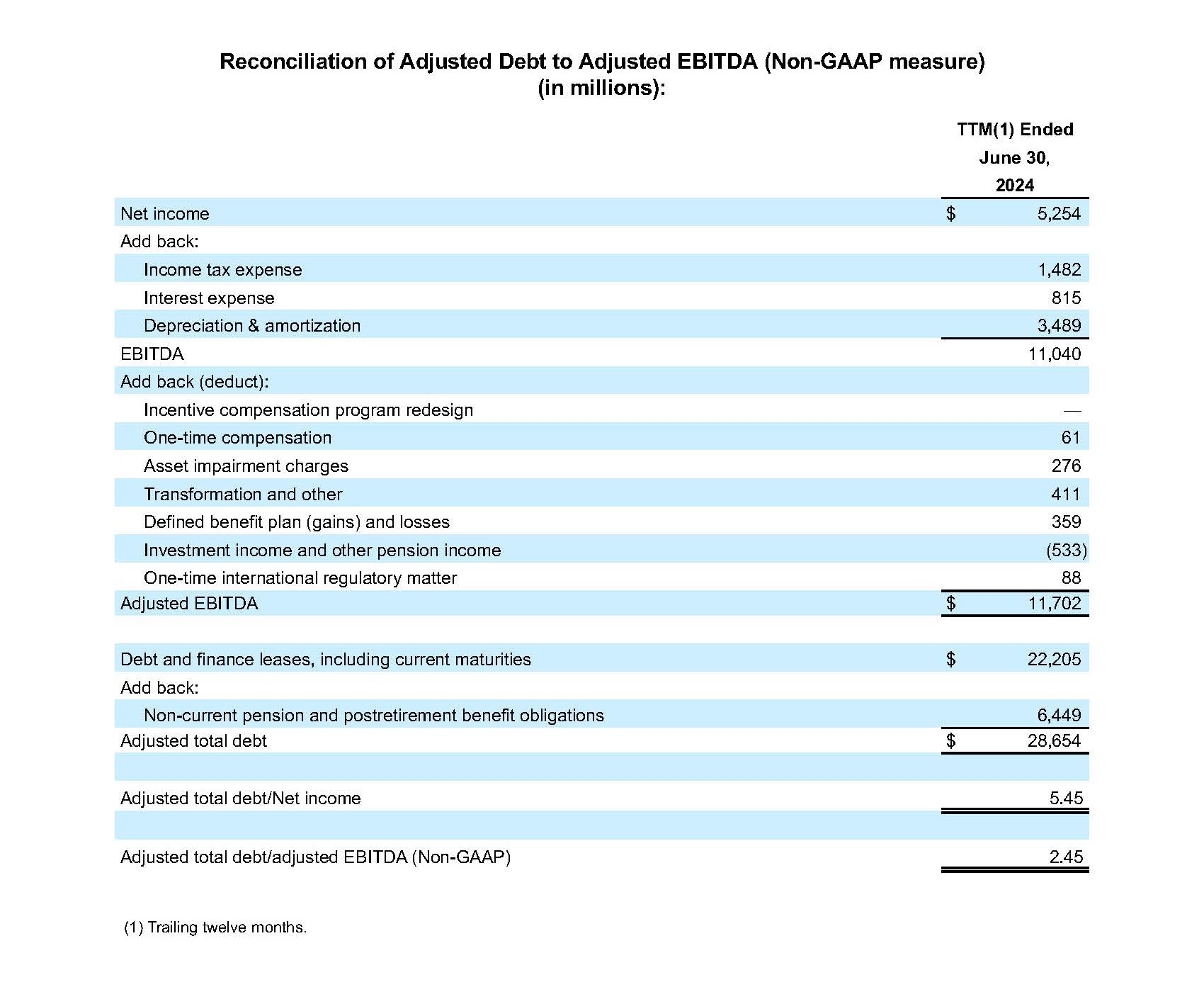

調整後的總債務 / 調整後的 EBITDA

調整後的總債務定義為我們的長期債務和融資租賃,包括本年到期的部分,加上非當期退休金與退休後福利義務。調整後的 EBITDA 定義為根據激勵薪酬計劃重新設計、一次性薪酬、商譽和資產減值費用、轉型和其他成本、一次性國際監管事務、設定受益計劃損益以及其他收入的影響進行調整的息稅折舊攤銷前利潤。我們認為調整後的總債務和調整後的 EBITDA 之間的比值是體現我們財務實力的重要指標,而且第三方在評估我們的債務時也會使用這個比值 。

調整後的每件成本

我們利用各種指標來評估我們的營運效率,包括調整後的每件成本。調整後每件成本的算法是將某一期間的調整後營業費用除以該期間的總量。由於調整後營業費用不包括我們在監控和評估業務部門的營運績效、做出資源配置決策,或確定激勵性薪酬獎勵時不視為基本業務績效一部分的成本或費用,因此,我們認為這是審查和評估我們營運表現效率的適當指標。