- 综合收入为 253 亿美元,而去年同期为 249 亿美元

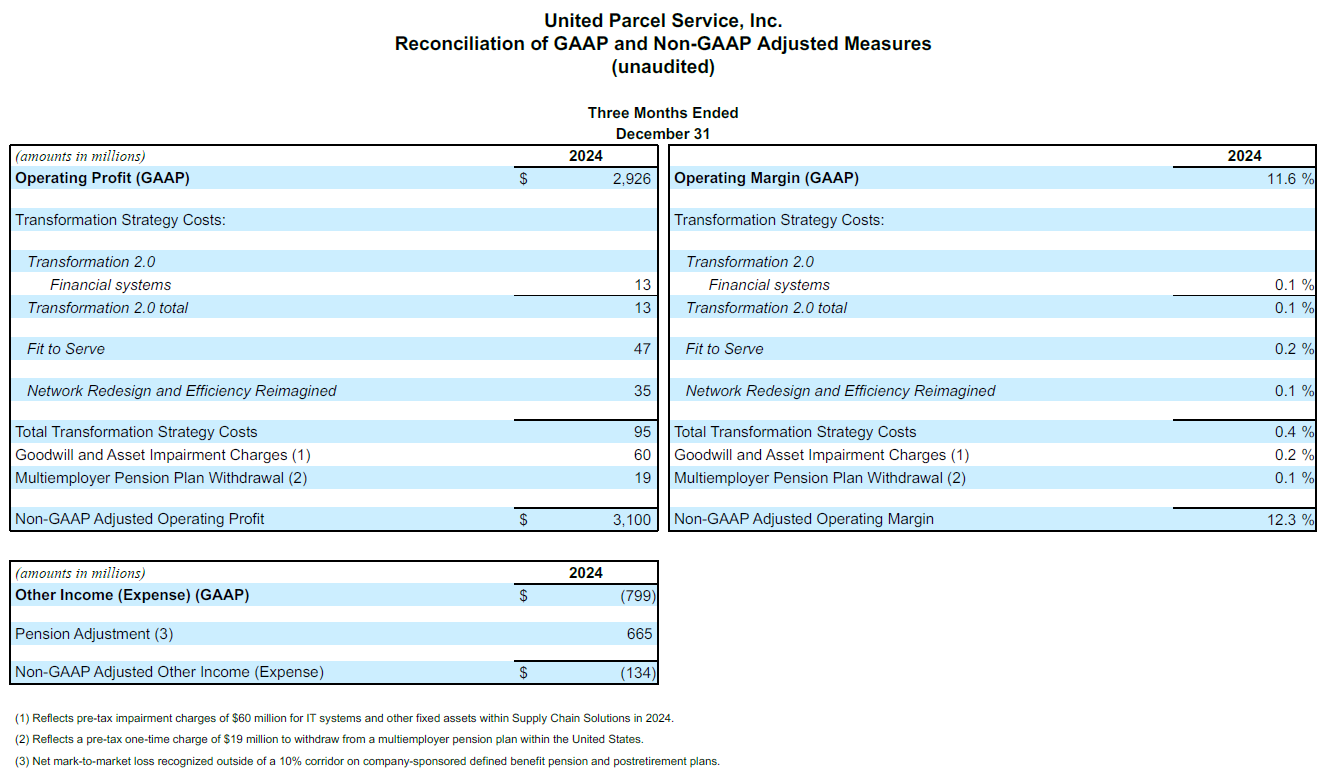

- 综合营业利润率为 11.6%;非 GAAP(一般公认会计原则)调整后*的综合营业利润率为 12.3%

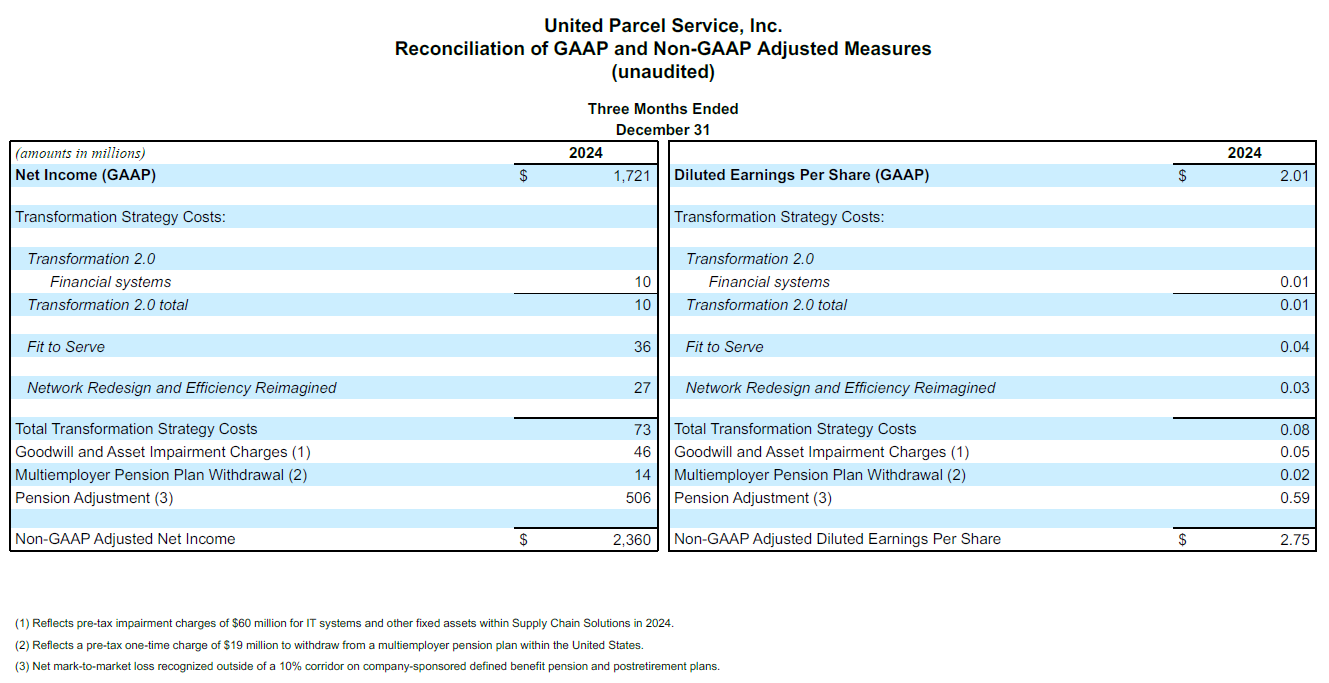

- 摊薄每股收益为 2.01 美元;非 GAAP 调整后摊薄每股收益为 2.75 美元,而去年同期为 2.47 美元

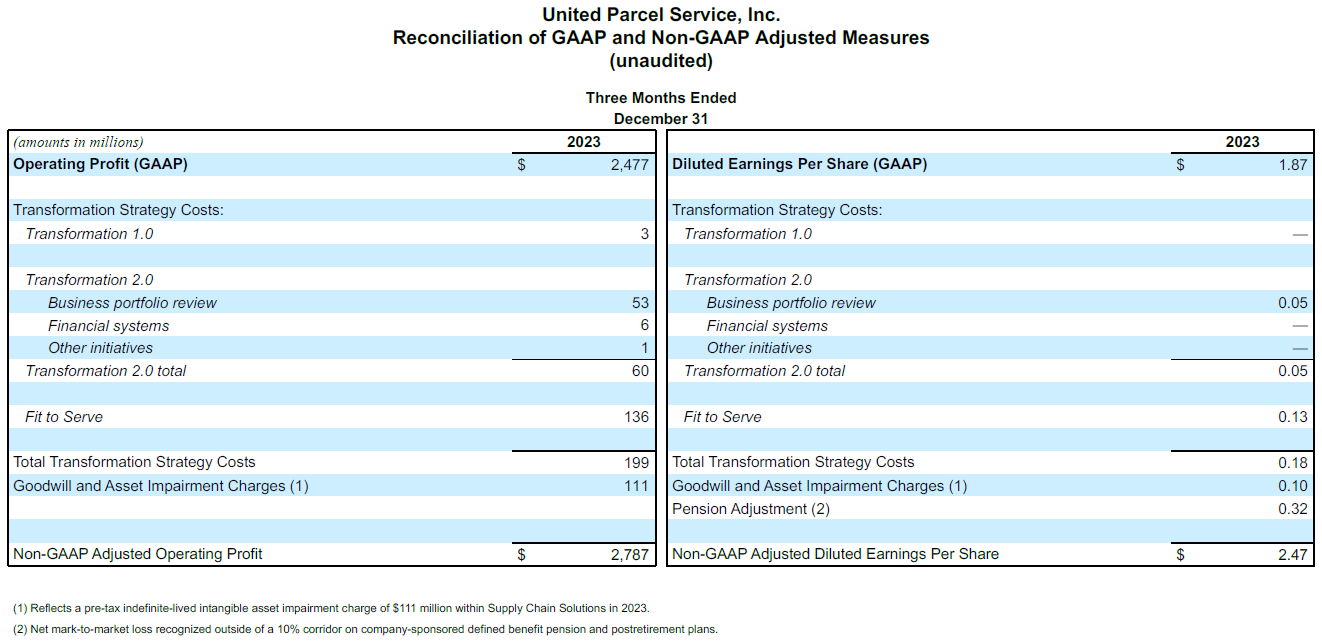

亚特兰大 – 2025 年 1 月 30 日 – UPS(纽约证券交易所代码:UPS)今日宣布 2024 年第四季度综合收入为 253 亿美元,较 2023 年第四季度增长 1.5%。综合营业利润为 29 亿美元,较 2023 年第四季度上涨 18.1%,非 GAAP 调整后上涨 11.2%。该季度摊薄每股收益为 2.01 美元;非 GAAP 调整后摊薄每股收益为 2.75 美元,比 2023 年同期提高 11.3%。

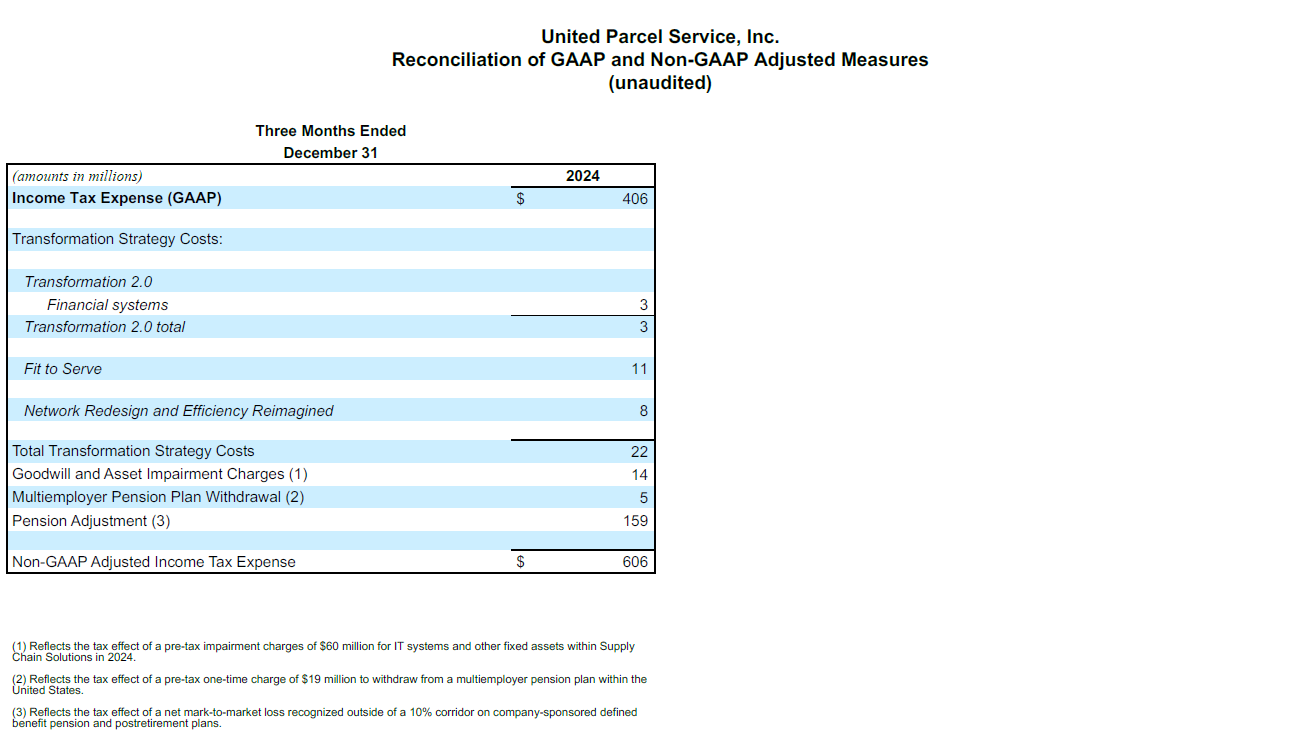

2024 年第四季度的 GAAP 业绩包括 6.39 亿美元的总费用(即每股摊薄收益 0.74 美元),其中包括 5.06 亿美元的非现金税后按市值计价 (MTM) 养老金费用、税后转型战略总成本 7,300 万美元、税后资产减值费用 4,600 万美元,以及与多雇主养老金计划提款相关的税后成本 1,400 万美元。

UPS 首席执行官 Carol Tomé 表示,“感谢 UPS 全体员工,正是他们的辛勤工作和努力使我们实现 2024 年圆满收官,为客户提供一流服务并取得了强劲的财务业绩,提前完成了本季度的目标。”

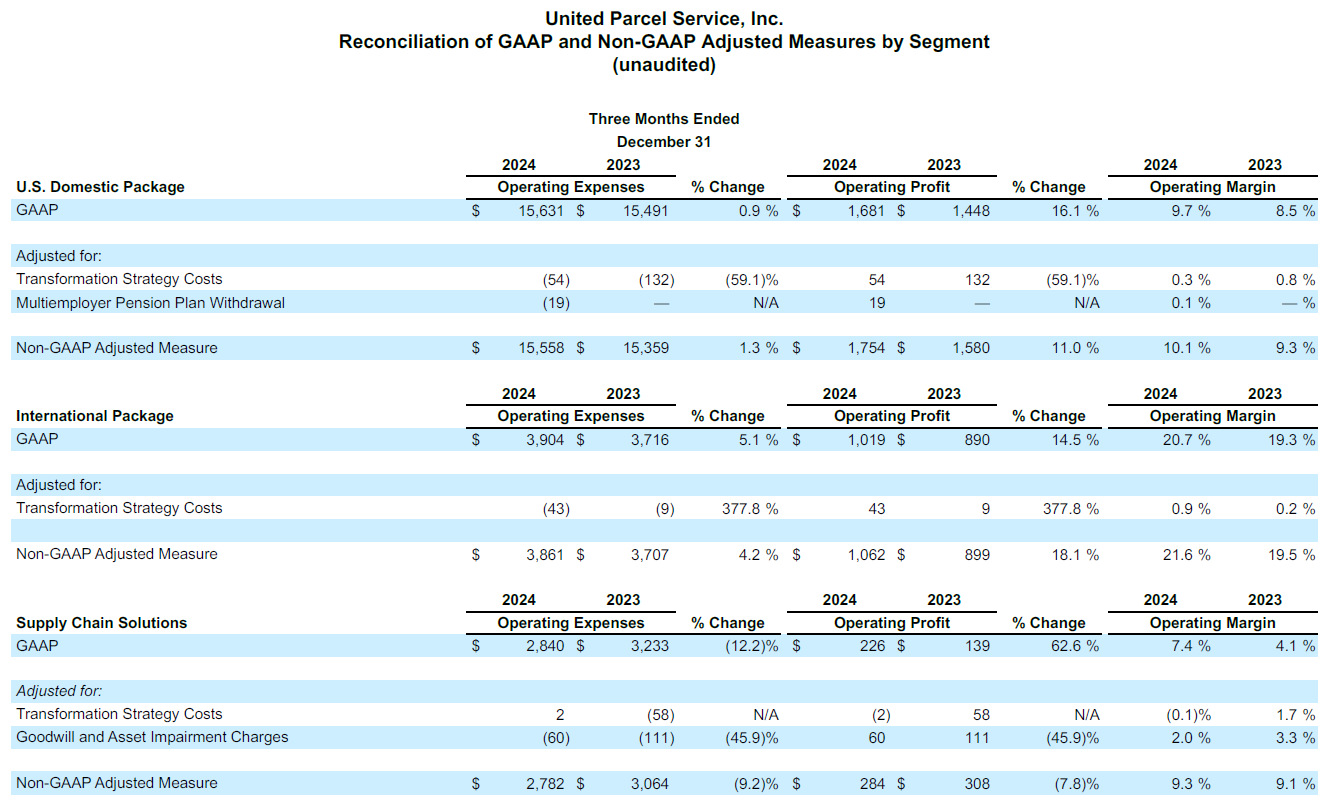

美国国内业务†

| 第四季度2024 | 非 GAAP 调整后 第四季度2024 | 第四季度2023 | 非 GAAP 调整后 第四季度2023 |

营收 | 17,312 百万美元 |

| 16,939 百万美元 |

|

营业利益 | 1,681 百万美元 | 1,754 百万美元 | 1,448 百万美元 | 1,580 百万美元 |

- 收入增长 2.2%,得益于每件货件收入增长 2.4% 和航空货运量增加。

- 营业利润率为 9.7%;非 GAAP 调整后营业利润率为 10.1%。

国际业务

| 第四季度2024 | 非 GAAP 调整后 第四季度2024 | 第四季度2023 | 非 GAAP 调整后 第四季度2023 |

营收 | 4,923 百万美元 |

| 4,606 百万美元 |

|

营业利益 | 1,019 百万美元 | 1,062 百万美元 | 890 百万美元 | 899 百万美元 |

- 收入增长 6.9%,得益于日均货运量增加 8.8%。

- 营业利润率为 20.7%;非 GAAP 调整后营业利润率为 21.6%。

供应链解决方案1 †

| 第四季度2024 | 非 GAAP 调整后 第四季度2024 | 第四季度2023 | 非 GAAP 调整后 第四季度2023 |

营收 | 3,066 百万美元 |

| 3,372 百万美元 |

|

营业利益 | 226 百万美元 | 284 百万美元 | 139 百万美元 | 308 百万美元 |

1 包括不符合《ASC Topic 280 – 细分业务报告》下的可报告细分业务标准的经营业务。

- Coyote 剥离后收入减少,空运和海运业务的增长部分抵消了收入下降的影响,最终营收下跌 9.1%。

- 营业利润率为 7.4%;非 GAAP 调整后营业利润率为 9.3%。

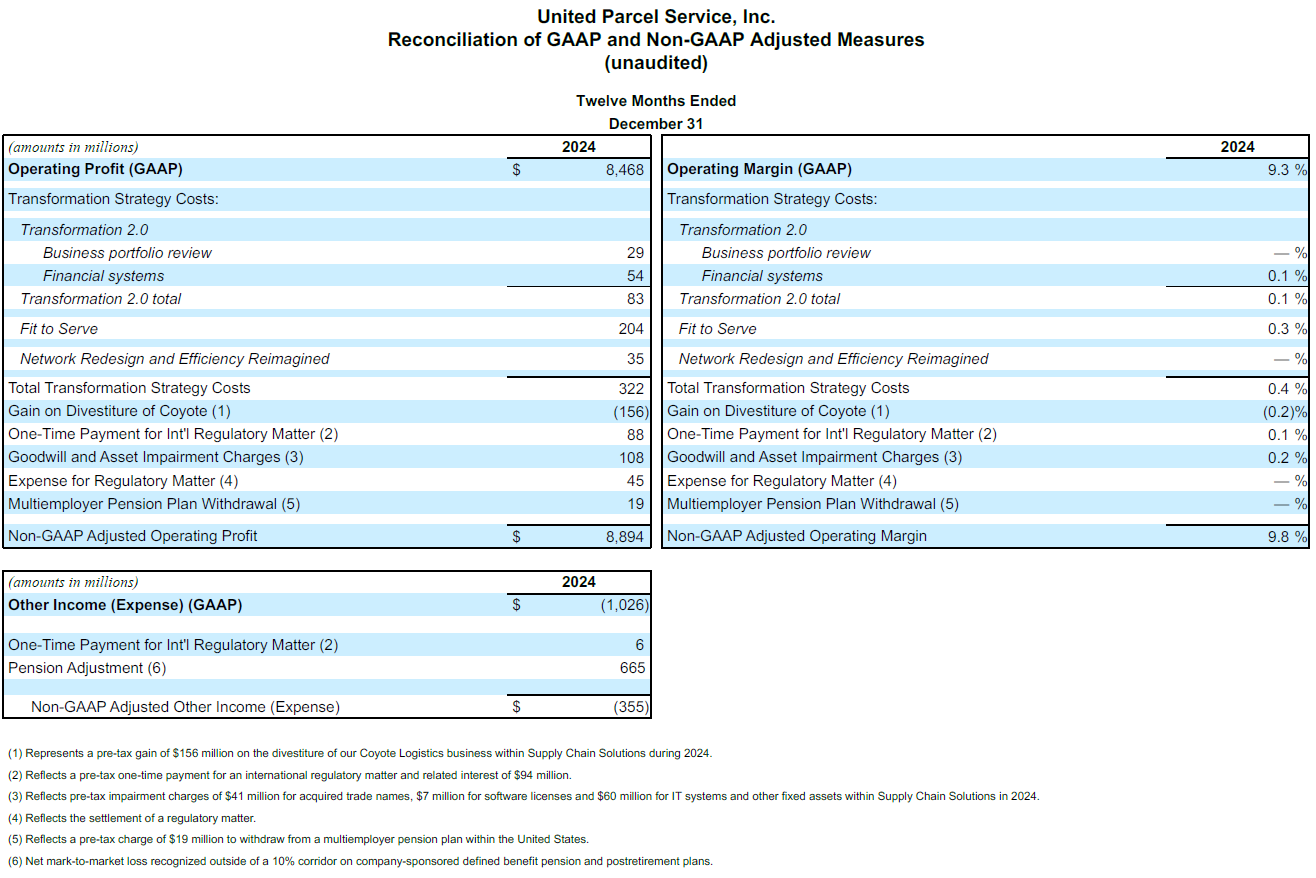

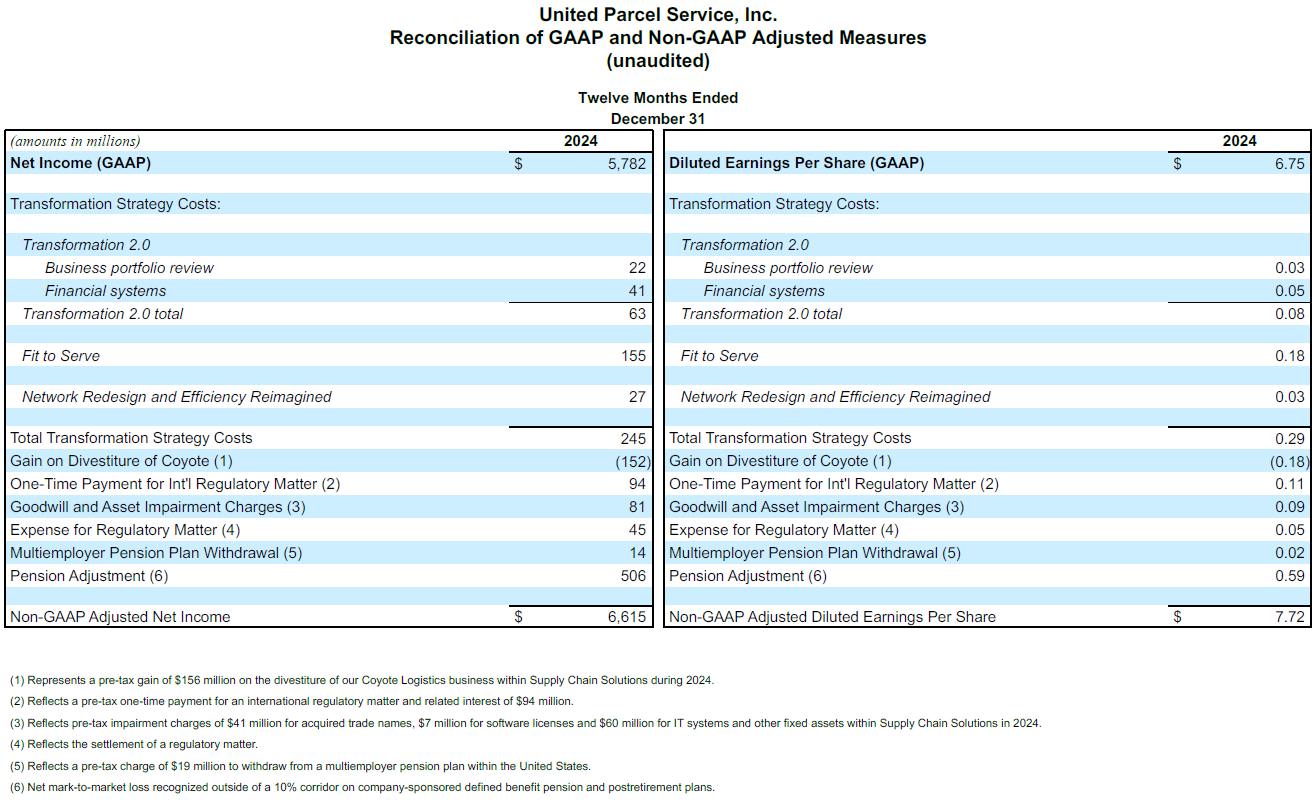

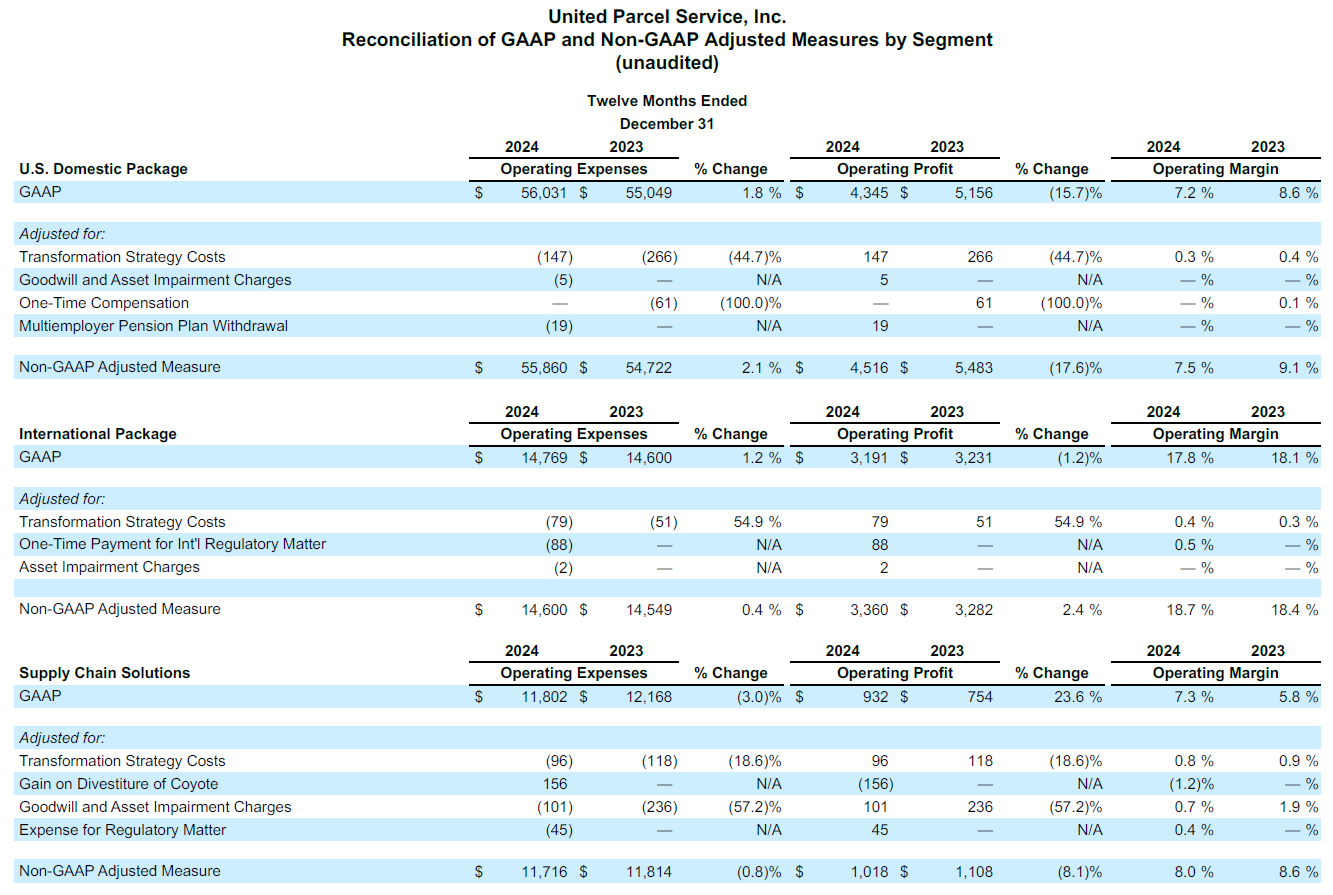

2024 年全年度综合业绩

- 收入为 911 亿美元。

- 营业利润为 85 亿美元;非 GAAP 调整后营业利润为 89 亿美元。

- 营业利润率为 9.3%;非 GAAP 调整后营业利润率为 9.8%。

- 摊薄每股收益总额为 6.75 美元;非 GAAP 调整后的摊薄每股收益为 7.72 美元。

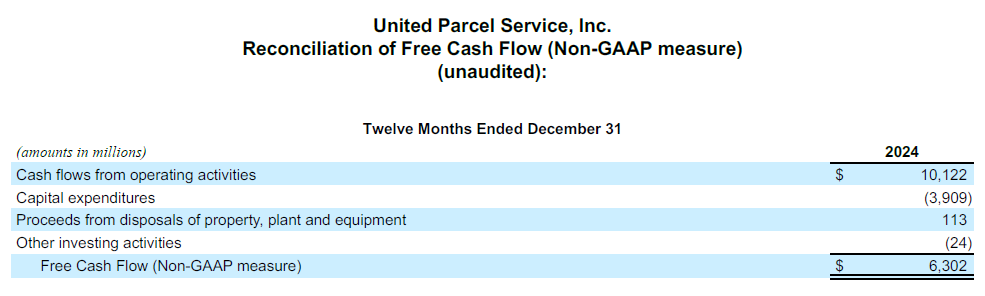

- 运营现金为 101 亿美元,非 GAAP 调整后的自由现金流为 63 亿美元。

此外,公司以股息和股票回购的方式,向股东提供 59 亿美元的现金回报。

2025 年展望

公司可在非 GAAP 调整后的基础上提供一定指导,原因是无法预测各种潜在未来事件(包括养老金调整、某些战略计划或其他非常规事件),也无法提供反映这些事件所造成的影响的协调信息,这些事件可能包括在报告的 (GAAP) 业绩范围内,而且可能属于重大事项。

公司今日宣布以下一系列战略行动:首先,公司已经与最大客户在原则上达成协议,到 2026 年下半年将其货运量降低 50% 以上;其次,自 2025 年 1 月 1 日 起,公司已经将其 UPS SurePost 业务 100% 内包;第三,公司为配合上述行动正在重组其美国网络,并启动多年期“效率重构”(Efficiency Reimagined) 计划,以便通过重新设计端到端流程,节省约 10 亿美元。

Tomé 表示,“我们正在进行业务和运营方面的变革,加上我们已做出的基础性变革,将进一步推动 UPS 成为一个盈利能力更强、更灵活和差异化优势更明显的公司,在最优质的市场领域不断发展壮大。”

2025 年全年,UPS 预计综合收入约为 890 亿美元,综合营业利润率约为 10.8%。

公司计划资本支出约 35 亿美元,股息支付约为 55 亿美元,但须经董事会批准,股票回购约为 10 亿美元。预计有效税率约为 23.5%。

*“非 GAAP 调整后”金额为非 GAAP 调整后的财务指标。请参考本新闻稿的附录,了解有关非 GAAP 调整后财务指标的讨论,包括调节最密切相关的 GAAP 指标。

† 为了与本年度列报保持一致,对上一年度的某些金额进行了重新分类,包括将航空货运量重新归类为美国国内货运量,但综合业绩不变。某些金额按未四舍五入的数字进行计算。

联系人:

UPS 媒体关系:404-828-7123 或 pr@ups.com

UPS 投资者关系:404-828-6059(选项 4)或 investor@ups.com

# # #

视频会议信息

UPS 首席执行官 Carol Tomé 和首席财务官 Brian Dykes 将于 2025 年 1 月 30 日 美国东部时间上午 8:30 举行电话会议,与投资者和分析师讨论第四季度的业绩。其他人将可通过实时网络直播参与视频会议。如需参加电话会议,请访问 www.investors.ups.com,并点击“营收电话会议”。其他财务信息包括在 www.investors.ups.com 上“季度收益和财务”下公布的详细财务清单,这些清单作为目前的 8-K 表格报告的附件提交给美国证券交易委员会 (SEC)。

关于 UPS

UPS(纽约证券交易所代码:UPS)是全球最大公司之一,2023 年营收为 910 亿美元,为 200 多个国家和地区的客户提供广泛的物流整合方案。公司专注于“执行意义深远的递送服务,推动世界向前迈进”的宗旨,公司大约 500,000 多名员工接受该表述简单且易于执行的战略:客户至上。以人为本。致力创新。UPS 致力于减少其对环境的影响,并为我们在全球所服务的社区提供支持。更多信息见 www.ups.com、about.ups.com 和 www.investors.ups.com。

前瞻性陈述

本新闻稿、我们截至 2023 年 12 月 31 日的 10-K 表格年度报告,以及我们向美国证券交易委员会提交的其他文件包含并且将来可能包含“前瞻性陈述”。除了对于现时事实或过往事实的陈述之外,所有包括“将”、“相信”、“计划”、“预期”、“预估”、“假定”、“打算”、“期望”、“目标”、“方案”和类似的条款,均意指前瞻性陈述。

我们也不时在其他公开揭露数据中提供包含书面或口头的前瞻性陈述。此前瞻性陈述可能与关于我们战略方向、前景、未来结果或未来活动的意图、信念、预测或预期有关;这些并不与过往或现时事实确切相关。管理层相信这些前瞻性陈述到时候会是合理的。但是,应注意不应过度依赖任何前瞻性陈述,因为此类陈述仅在陈述当时和未来无法预测定性的情况。

前瞻性陈述受某些风险和不确定性限制,可能导致实际结果与历史经验和现行期望或预期的结果有显著的不同。这些风险和不确定性包括但不限于:美国或国际总体经济状况的变化;地方、区域、国家和国际层面的重大竞争;我们与重要客户关系的变化;我们吸引和留住人才的能力;我们员工的罢工、停工或怠工行为;更多或更复杂的实体或运营安全要求;重大网络安全事件,或数据保护法规加强;我们维护品牌形象和企业声誉的能力;全球气候变化影响;自然或人为事件或灾难(包括恐怖袭击、流行病或疫情)对我们的业务造成中断或影响;对国际和新兴市场不断变化的经济、政治、监管和社会发展情况的接触了解;我们通过收购、处置、合资企业或战略联盟实现预期收益的能力;包括汽油、柴油、航空燃油和其他燃料在内的能源价格变化以及这些商品供应中断的影响;汇率或利率的变化;我们准确预测未来资本投资需求的能力;与员工健康、退休人员健康和/或养老金福利相关的费用和资金义务增加;我们管理保险和理赔费用的能力;可能导致我们资产减值的企业战略、政府法规、经济或市场条件的变化;其他潜在的美国或国际税负;与气候变化相关日益严格的法规;与劳动和就业、人身伤害、财产损失、商业惯例、环境责任和其他事项有关的潜在索赔或诉讼;以及我们不时向美国证券交易委员会提交的文件中探讨的其他风险,包括我们截至 2023 年 12 月 31 日的 Form 10-K 年报和其他后续提交的报告。您应该考虑与前瞻性陈述相关的限制和风险,而非过度仰赖这类前瞻性陈述中所包含的预测准确性。除非法律规定所规定之外,我们并不承担任何更新前瞻性声明以反映在这些声明后发生的事件、情形、期望变化或意外事件的义务。

公司定期在公司的投资者关系网站 (www.investors.ups.com) 上发布重要信息,包括新闻稿、公告、在分析师或投资者会议上提供或展示的材料,以及有关公司业务和运营业绩的其他声明,这些信息可能被视为对投资者具有重大意义。公司将其网站作为披露重大非公开信息以及履行 FD 条例规定的公司披露义务的一种方式。投资者除了关注公司的新闻发布、向美国证券交易委员会提交的文件、公开电话会议和网络广播外,还应关注公司的投资者关系网站。我们不会将任何网站的内容纳入本报告或向美国证券交易委员会提交的任何其他报告中。

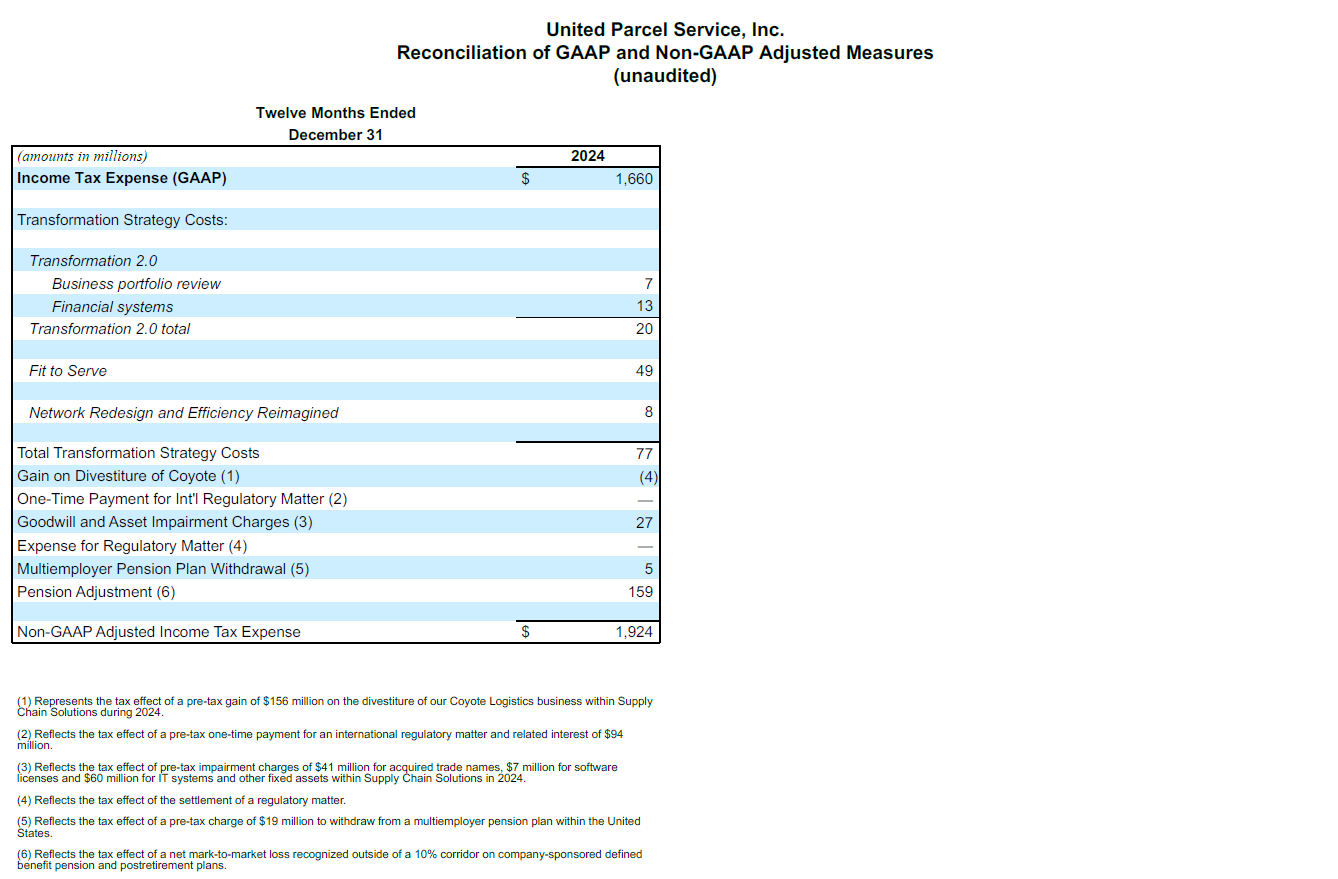

GAAP 与非 GAAP 调整后财务指标调节

我们使用某些非 GAAP 调整后财务指标来增补依据一般公认会计原则(简称“GAAP”)确定的财务信息报告。管理层在剔除与这些非 GAAP 调整后财务指标相关的成本和收益后,按照 GAAP 来审查和评估业绩。因此,我们认为,提供这些非 GAAP 调整后财务指标可以让我们的财务信息的使用者更好地从与管理层相同的视角来审查和评估基本业绩。

非 GAAP 调整后财务指标应被视为对我们根据 GAAP 编制的报告结果的补充,而不是替代。我们的非 GAAP 调整后财务指标不代表综合会计基础,因此可能无法与其他公司报告的类似名称的指标进行比较。

前瞻性非 GAAP 调整后财务指标

当我们展现前瞻性非 GAAP 指标时,我们无法提供关于最关联 GAAP 指标的量化核对,原因时任何调整的时间、数量或特性有所不同,材料的时间可能存在差异。

国际监管事务一次性付款

我们在提供营业利润、营业利润率、利息支出、其他收入(支出)总额、税前收入、净收入和每股收益等报告内容时补充使用了非 GAAP 指标,其中排除了 2024 年第二季度一次性支付的 9,400 万美元先前受限现金的影响,这笔现金用于解决此前披露的意大利税务机关对 UPS 向某些第三方服务提供商支付的增值税可抵扣性的质疑,并且对该质疑的审查已于 2023 年第四季度启动。我们认为这并不是我们持续运营的组成部分,并且预计不会再次发生这种或类似的付款。

监管事务费用

我们在提供营业利润、营业利润率、利息支出、其他总收入(费用)、税前收入、净收入和每股收益等报告内容时补充使用了非 GAAP 指标,其中排除了解决一项监管事务产生的费用的影响,我们认为该监管事务与我们的持续运营无关,并且预计不会再次发生。

转型战略成本

我们在提供营业利润、营业利润率、税前收入、净收入和每股收益等报告内容补充使用了非 GAAP 指标,其中排除了与我们转型战略活动相关的费用的影响。我们的转型活动已经持续数年,从根本上改变我们的组织结构、流程、技术和业务组合构成的跨度和层级。虽然这些转型活动的早期阶段已于 2023 年完成(转型 1.0),但某些系统实施和业务组合审查活动(转型 2.0)仍在进行中,预计将持续到 2025 年。我们此前宣布了 Fit to Serve 计划的多项举措,通过在 2024 年裁员约 12,000 个工作岗位来适当调整业务规模,建立更加高效的运营模式,增强对不断变化的市场环境的响应能力。这些举措是在各种情况下促成的,包括根据高层领导人事变动确定投资的优先次序、竞争格局的发展和变化、通货膨胀压力、消费者行为以及其他因素,比如新冠肺炎疫情后正常化和 2023 年劳资谈判导致的货运量转移。

正如 2025 年 1 月 30 日 所披露的,我们正在开始网络重组,预计将在 2025 年至 2027 年期间整合我们的设施和员工队伍,并重新设计端到端流程。我们的网络重组预计将引发退出活动,从而可能会导致我们关闭多达 10% 的办公楼,缩小我们的车队和机队规模,以及减少我们的员工人数。这些成本不包括在我们可能产生的运营成本中。我们尚无法确定受网络重组影响的具体资产或员工人数、这些未来变化的时间或我们将产生的相关费用,因此目前无法估算总成本或分期计算的成本。我们预计,在网络重组的部分或整个期间,受影响的资产仍将继续使用。

我们希望通过“效率重构”计划,在网络重组期间进行端到端流程重新设计,从而部分抵消所产生的成本。我们正在实施这项计划,以使我们的组织流程与网络重组过程中预计发生的运营变化保持一致,并提高组织效率。这项计划预计每年将节省约 10 亿美元。2024 年 12 月 31 日 之前的三个月,我们产生的相关成本为 3,500 万美元。我们预计,在 2025 年期间将产生约 3 亿至 4 亿美元的相关费用,主要与外部专业服务和遣散有关。在完成网络重组和“效率重构”计划后,我们预计在随后的时间里通过降低费用(包括折旧、薪酬、福利和其他费用,以及资金需求减少)来实现进一步收益。

我们认为相关成本不属于普通成本,因为每个计划都涉及单独和不同的活动,这些活动可能跨越多个时段,预计不会推动收入增加,而且这些计划的范围超出了为提高盈利能力而持续开展的日常工作的范围。这些举措不是为提高业绩而持续开展的日常工作的一部分。

商誉和资产减值

我们在提供有关营业利润、营业利润率、税前收入、净收入和每股收益等报告内容时补充使用了非 GAAP 指标,其中排除了商誉和资产减值费用的影响。我们在评估业务单位的运营绩效、决定资源分配或确定激励性薪酬奖励时,不会考虑这些费用。

与资产剥离相关的损益

我们在提供有关营业利润、营业利润率、税前收入、净收入和每股收益等报告内容时补充使用了非 GAAP 指标,其中排除了与业务剥离相关的收益(或损失)的影响。我们在评估业务单位的运营绩效、决定资源分配或确定激励性薪酬奖励时,不会考虑这些交易。

一次性补偿付款

我们在提供有关营业利润、营业利润率、税前收入、净收入和每股收益等报告内容时补充使用了非 GAAP 指标,其中排除了 2023 年我们与国际卡车司机工会签订劳工协议后一次性支付给美国某些非工会兼职主管的款项的影响。预计该付款或类似付款不会再发生。

多雇主养老金计划提款

我们在提供营业利润、营业利润率、税前收入、净收入和每股收益等报告内容时补充使用了非 GAAP 指标,其中排除了与从美国多雇主养老金计划中提取相关的费用的影响。我们认为这些成本与我们的持续运营无关,并且预计不会再次发生。

非 GAAP 调整后每货件成本

我们使用包括非 GAAP 调整后每货件成本在内的各种指标来评估我们的运营效率。非 GAAP 调整后每货件成本的计算方式为:某一期间的非 GAAP 调整后运营支出除以该期间的货件总量。我们认为有些成本或费用不属于基本业绩的组成部分,也不属于监控和评估业务单位运营绩效、决定资源分配或确定激励性薪酬奖励的范畴;因此我们相信,不将这些成本或费用纳入非 GAAP 调整后运营支出是审查和评估我们运营绩效效率的正确衡量方法。

固定养老金福利和退休后医疗计划损益

我们将计划资产公允价值的变化,以及超出 10% 缓冲区(定义为计划资产公允价值或计划预计收益义务的 10%,以较高者为准)的退休金和退休后定义的收益计划之债务净精算损益和计划缩减及结算损益,直接认定为一部分的其他退休金收入(支出)。我们使用调整后的指标(可排除损益影响以及相关的所得税效应),提供有关税前收入、净所得及每股收益的更多信息。我们相信,排除这些固定养老金福利和退休后计划损益影响,可通过消除与市场利率、股票价值和类似因素的短期变化有关的波动,提供重要的补充信息。

自由现金流量

我们计算自由现金流量的方式是:在营业活动所得现金流量小于资本支出时,将来自不动产、厂房和设备处理的收入,加上或扣除财务其他投资活动的净变动。我们认为,自由现金流量是重要的指标,可了解当前业务运营产生的现金有多少,而且我们运用此指标评估可投入于投资业务、承担债务及回馈给股东的增量现金。

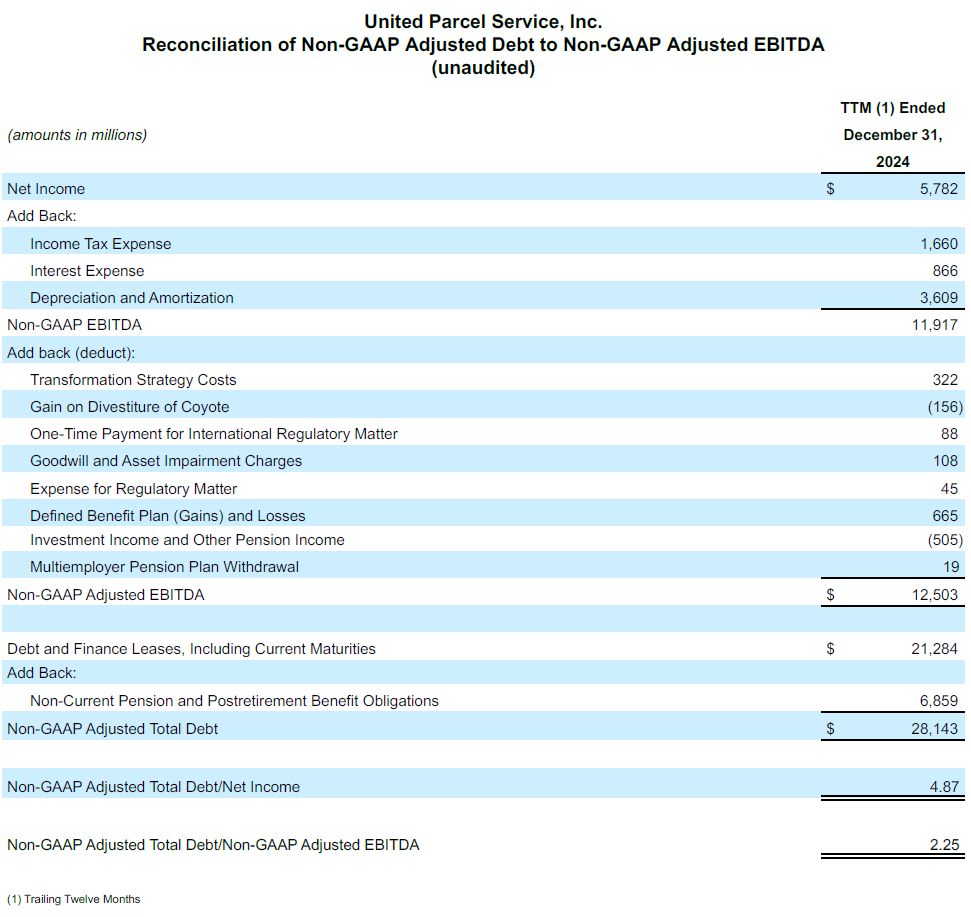

非 GAAP 调整后的总债务/非 GAAP 调整后的 EBITDA

非 GAAP 调整后的总债务是指我们的长期债务和融资租赁,包括本年到期、以及非流动养老金和退休后福利义务。非 GAAP 调整后的 EBITDA 是指根据——转型战略成本、剥离 Coyote 的收益、国际监管事项一次性付款、商誉和资产减值费用、一次性补偿付款、监管事项相关费用、固定福利计划损益、投资收益和其他养老金收入以及从多雇主福利计划中提款的费用——进行调整后的税息折旧及摊销前利润。我们相信,调整后总债务与调整后 EBITDA 之比是我们展现经济实力的重要指标,且为评估我们的债务级别时,第三方使用的比例。

非 GAAP 调整后投资资本回报率

非 GAAP 调整后的投资资本回报率 (ROIC) 的计算方式为:过去 12 个月 (TTM) 的调整后营业收入除以本期末和上年同期末的总债务、非流动养老金和退休后福利义务以及股东权益的平均值。由于非 GAAP 调整后的 ROIC 并非由 GAAP 定义的指标,我们部分使用我们认为最能说明我们的持续业务绩效的、非 GAAP 财务指标来计算。我们认为非 GAAP 调整后的 ROIC 是评估长期资本投资有效性和效率的有用指标。